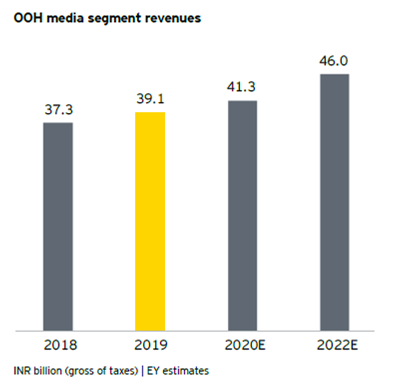

OOH to reach Rs 46bn level in 2022 from Rs 39.1bn in 2019: FICCI-EY M&E Report

By Bhawana Anand - March 30, 2020

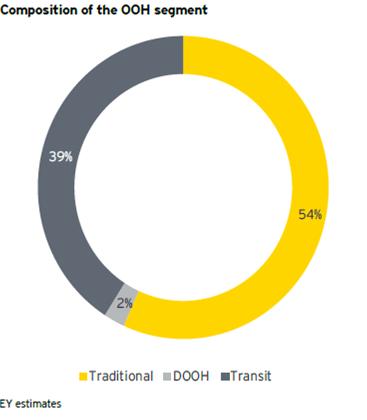

Traditional media accounted for 54% of total OOH revenues, transit 39%, DOOH 2%

The just released FICCI-EY Media & Entertainment report entitled ‘The era of consumer A.R.T.’ cites that India’s media and entertainment industry reached the size of Rs 1.82 trillion in 2019, growing at 9% over the previous year. The acronym A.R.T., in its expanded form being Acquisition, Retention and Transaction’, typifies the industry’s multi-fold engagements with consumers.

The just released FICCI-EY Media & Entertainment report entitled ‘The era of consumer A.R.T.’ cites that India’s media and entertainment industry reached the size of Rs 1.82 trillion in 2019, growing at 9% over the previous year. The acronym A.R.T., in its expanded form being Acquisition, Retention and Transaction’, typifies the industry’s multi-fold engagements with consumers.

Ashish Pherwani, M&E Sector Leader, EY India in his foreword to the report states, “The M&E sector witnessed a surge in content consumption as digital infrastructure, quantum of content produced and per-capita income all increased in 2019. Consequently, driven by the ability to create direct-to-customer relationships, the sector firmly pivoted towards a B2C operating model, changing the way it measured itself.”

Ashish Pherwani, M&E Sector Leader, EY India in his foreword to the report states, “The M&E sector witnessed a surge in content consumption as digital infrastructure, quantum of content produced and per-capita income all increased in 2019. Consequently, driven by the ability to create direct-to-customer relationships, the sector firmly pivoted towards a B2C operating model, changing the way it measured itself.”

The forecast is for the M&E industry to reach the size of Rs 2.42 trillion (US$34 billion) by 2022 at a CAGR of 10%. OOH reached the size of Rs 39.1 billion in 2019 and is forecasted to grow to Rs 41.3 billion in 2020, Rs 46 billion in 2022.

In 2019, traditional media accounted for 54% of total OOH revenues, transit 39% and DOOH 2%.

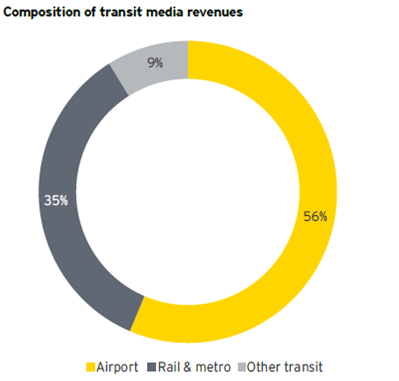

The OOH growth in 2019 was powered by airport advertising, Metro station naming rights, and the Indian Railways’ push to drive non-fare revenue growth, says the report. The growth was assessed on the basis of coverage of traditional, transit and digital media, but excludes untracked OOH media such as wall paintings, ambient media, proxy advertising, etc. which could added up to an additional Rs 10-15 billion.

The report cites that DOOH contributed 2% of total OOH revenues (Rs 1 billion) and is forecast to grow at a CAGR of over 33% to reach Rs 2 billion by 2022.

Top spending categories in OOH

Top spending categories in OOH

OTT category emerged as the leading spending category in 2019 in the OOH space, whereby various players used the medium for different launch promotions. Other top spending categories were real estate, FMCG, financial services and media. The top 5 categories contributed 65% of OOH spends.

Transit media

Continuing its pace, the transit sector is set to grow from 39% in 2019 to 44% in 2020 of the total segment. Railway media accounted for about Rs 10 billion OOH revenue in 2019. Transit media is expected to be driven by new Metro rail expansions, new airport routes and new airports, bus shelter/terminal development, etc.

Looking ahead

The report says that aggregation of location-based data along with opportunity-to-see data are marking a change in how OOH is purchased. Platforms will likely emerge to automate and simplify the process of serving the demand from local and regional advertisers, providing them with options on OOH as well as geo-targeted digital inventory, as media owners become agencies providing 360-degree solutions across digital and OOH.

The report says that aggregation of location-based data along with opportunity-to-see data are marking a change in how OOH is purchased. Platforms will likely emerge to automate and simplify the process of serving the demand from local and regional advertisers, providing them with options on OOH as well as geo-targeted digital inventory, as media owners become agencies providing 360-degree solutions across digital and OOH.

India has over 100 direct-to-customer brands that require physical presence hence OOH partnerships will benefit these brands and could expect equity for space deals in this space.

DOOH networks will be connected to large ad platforms to fill up inventory and it is possible

that consolidation could take place within two to three years in media owners. There is also an opportunity for technology companies to provide services like design, scheduling, traffic, invoicing, payment management, etc. for international DOOH companies out of India.

The report also clearly states that the findings were established before the COVID-19 outbreak. Accordingly, estimates for CY2020 provided in the report have not been updated basis the impact of the coronavirus fallout. The forecasts will be revised going forward.