Powering Programmatic OOH in Asia markets

By Rajiv Raghunath - November 12, 2021

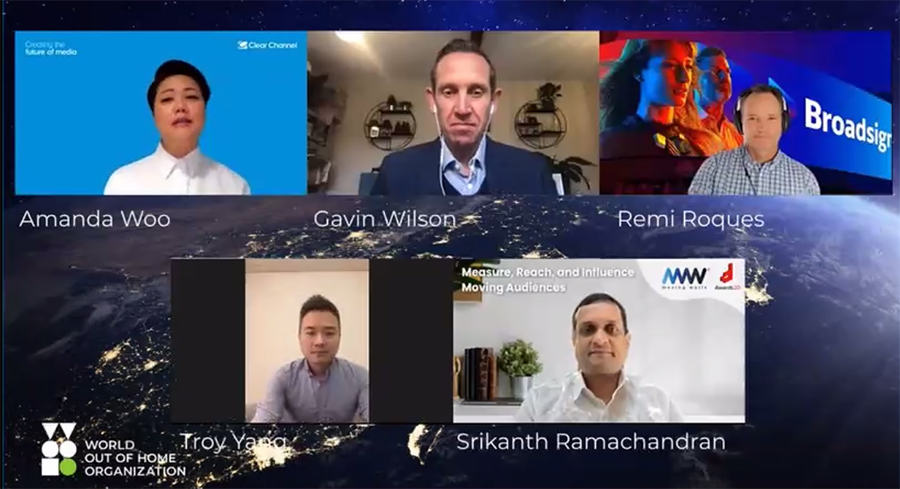

A power-packed panel of industry experts discussed in depth the current state of programmatic OOH buying and selling, and the challenges to be addressed as programmatic OOH goes mainstream. The panel discussion was held in the Asia Forum organised by World Out of Home Organization on Oct 28

Addressing a session on ‘Asia - Programmatic Power Panel’ in the Asia Forum meeting of World Out of Home Organization (WOO) on October 28, Amanda Woo, Chief Development Officer at Clear Channel Singapore said in her opening remarks that

OOH has successfully overcome the pandemic challenge like no other media channel, bouncing back stronger than ever, with audiences demonstrating a renewed appreciation for outdoor advertising. “This has certainly sparked renewed advertiser interest in DOOH as a meaningful vehicle to connect consumers”.

Amanda pointed out that programmatic OOH is challenging the conventions of media planning, “because we are well placed to capitalise on the increasing consumer mobility movements, and demand the most scientific approach to buying OOH” that is fact-based and data driven.

So, what is really the meaning of programmatic? Is it about automated buying in real time bidding? Or, is it about selling premium or distressed inventory? Gavin Wilson, Global Chief Revenue Officer, VIOOH explained at the outset that programmatic OOH is no different to programmatic buying in any other channels. It's data driven and real time. Programmatic buying is advanced buying that takes into account many triggers and factors that ensure buyers and sellers get more from their campaigns, based on the targeting they want to apply to a campaign.

Gavin explained that on a programmatic platform sellers would be able to sell in advance by a guaranteed private marketplace deal or in a shorter term non-guaranteed fashion depending on the availability of media. Buyers on their part would have the luxury of flexible planning, the ability to move budget seamlessly from channel to channel based on their ever-changing goals and objectives or “simply if they want to dial up or down the campaign based on additional elements like weather, sports results, or even emission levels in the environment”.

Gavin stated that every other channel is going through the programmatic journey that OOH is now going through. “It doesn't have to be a direct or programmatic narrative. I think simplicity actually comes from knowing that buying Out Of Home direct and programmatically affords lots of value based on what the campaign wants to achieve”.

If an advertiser is looking to buy a specific, premium location, then a direct buy would be the preferred option. However, if the buy is indexed to certain other factors like certain times of day, traffic movements, etc., “a programmatic buy would be really optimal to achieve greater customer engagement and results,” he said.

Srikanth Ramachandran, Founder & Group CEO, Moving Walls explained that automation and intelligent automation are foundational to pDOOH. From the supplier side, automation helps to boost the revenues without incurring increasing costs, whereas on the demand side, programmatic is about optimisation – addressing questions like “can I ensure that my budget is well spent at the right locations”. “The minute they ask that question at the right locations at the right time, Intelligent Automation comes in, which becomes the targeting data sets”.

Hence, programmatic is “about a supply and demand ecosystem coming together with automation, and hopefully Intelligent Automation, so that the supplier benefits with more sales, the demand side the client benefits with better optimization and better targeting,” said Srikanth, while adding that Moving Walls as a brand continues to serve the agency and the demand side of the equation, while Location Media Exchange is about working with the suppliers to sell more.

Remi Roques, General Manager, Broadsign APAC drew parallels between e-commerce that revolutionised purchase of physical products, and programmatic OOH that is revolutionising the buying of DOOH media. Programmatic makes buying faster, with built-in flexibility that makes it the preferred route for buyers and sellers, he said, while underlining the success factors of pDOOH.

Troy Yang, Managing Director - North Asia, Hivestack pointed out that programmatic advertising helps buyers and sellers to make data-driven choices when it comes to buying and selling ads. And by leveraging DSPs and SSPs, buying and serving outdoor ads can be done automatically to drive optimal results and successful campaigns.

Programmatic platforms help marketers to visualise when and where there is highest concentrations of the client's target audience, in order to make real time decisions to serve the campaign ads at the right time, at the right place to the right audience, just like how campaigns are planned and rolled out in in other video digital channels.

Fragmentation media ownership and multiplicity of programmatic platforms are queering the pitch somewhat for players who are wanting to do business the programmatic way. Amanda said that in an environment like this, buyers could be overwhelmed by the number of platforms available in each market, and not being able t to access multiple inventories through a single DSP. On the supply side, media owners are also having to meet varied requirements from SSPs. She asked, “How do we begin to shape and narrow down the number of technology solutions in market. And what will it take to consolidate our offerings.”

Addressing the questions, Srikanth cited the story “about a Nike salesman landing in Africa, then calling his boss to say there's no market here, no one buys shoes. And then the next salesman lands in the same market, and he says, well, there's a few million people walking around without shoes, we've got a great market”. In that context, Srikanth said that “fragmentation is where the industry is today. And it's not just fragmentation in terms of asset types. It's also about software compatibility”. There is an opportunity to provide technology solutions that ensure ease of access to advertisers and the demand system.

Troy made the observation that fragmentation is real, whether it's on the buy side or the sales side. “On the buy side, look for the ones that are built for your needs. For example, there are many ways you can buy programmatic digital out of home ads, whether it is location buying or focusing on audience buys. But not all DSPs are equipped with the same targeting capabilities, so, look for the ones that really fit the needs. From a sales standpoint, consolidation is already happening, and or at least convergence. So, we're seeing some key players looking at some solutions from a universal perspective. And perhaps more convergence will happen around standardisations of matrix and measurements.”

Remi said that fundamentally programmatic helps consolidating buying and selling.

Today, an agency can buy assets of several media owners, unlike in the traditional way where agency media planners enter into negotiated, signed contracts with each supplier. He said that studies reveal 70% of programmatic transactions happen between agencies and media that were not in business together. “And as such, these bookings would have not been made otherwise”.

On driving demand for pDOOH, Amanda asked, what are the top three challenges to be addressed. Addressing this question, Gavin said that programmatic OOH is fast becoming a mainstream buy, evidenced by the growth in the current year versus 2020.

“The first challenge, in my opinion, is still the cross-channel positioning of programmatic OOH, that is, where does programmatic outdoor sit in the engagement funnel. And how is it best served and intertwined with other channels?”

Gavin underscored the need for a whole host of education to ensure planners buyers at big agencies and trading desks understand at what point to dial up or even dial down programmatic outdoor.

He also said that programmatic and mobile are fast becoming a great partnership. And the use of various location based data helps to tie the two channels together. “And we need more cases of this great partnership, and indeed other channels that are working in tandem to develop programmatic outdoor. This isn't just a case of where does programmatic outdoor benefit from other channels, but how can other channels benefit from the great engaged audience that are seeing premium media in premium outdoor locations, outdoor.”

Gavin noted that there's “an interesting shift occurring from planners and buyers that have indexed highly in other channels during the pandemic. They've spent a lot in, say mobile or social, or even in some markets, where they're fearing the imminent third party, Cookie regulations in display and what that will do for that channel”

He said these developments present a great opportunity for programmatic outdoor, to be seen as a brand safe, high value channel of choice for marketers looking to engage with an audience via premium screens.

The third challenge, in his view, springs from the gamut of tech solutions that are either being developed in-house or are outsourced. “Our State of the Nation report showed that advertisers are really split on how they're operating, programmatic, some in-house, somewhere outsourcing to media agencies, and some using a combination of both”.

pDOOH is a rapidly evolving side of OOH business. The panel discussion contributed to assessing the milestones that determine the roadmap for pDOOH in the coming years.

Stay on top of OOH media trends