OOH ad sales grew by +8.5% in US in 2018: Magna report

By M4G Bureau - April 08, 2019

The report shows that OOH is the only linear media type to experience consistent organic revenue growth

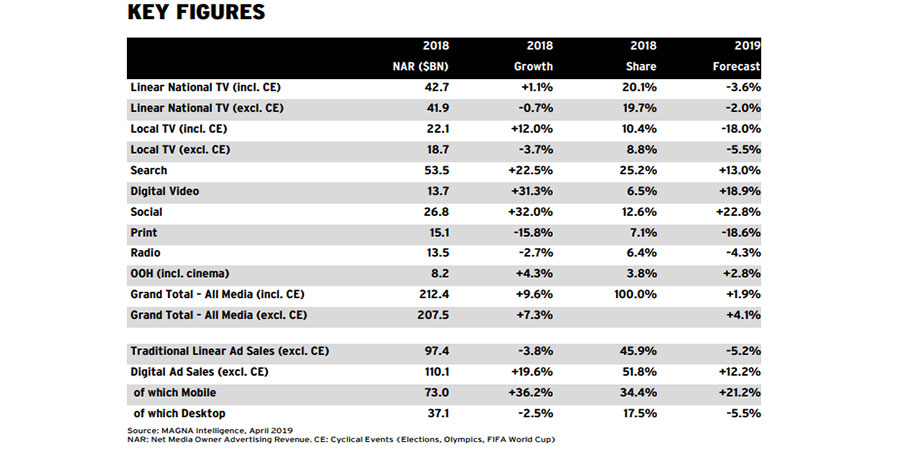

MAGNA released its updated estimates and forecasts on US media owners’ net advertising revenues (NAR). It reveals that advertising sales reached a new all-time high in 2018, at $212 billion. Advertising spending grew by almost +10% (+9.6% exactly), driven by the robust economic environment and cyclical ad spend (Winter Olympics, FIFA World Cup, Midterm Elections). It was the ninth consecutive year of growth and the strongest growth of the twenty-first century, exceeding the performance of 2016 (+9%).

MAGNA released its updated estimates and forecasts on US media owners’ net advertising revenues (NAR). It reveals that advertising sales reached a new all-time high in 2018, at $212 billion. Advertising spending grew by almost +10% (+9.6% exactly), driven by the robust economic environment and cyclical ad spend (Winter Olympics, FIFA World Cup, Midterm Elections). It was the ninth consecutive year of growth and the strongest growth of the twenty-first century, exceeding the performance of 2016 (+9%).

Out-of-home had its best quarter in more than a decade, as ad sales grew by +8.5% excl. cinema (digital screens: +20%, static panels: +6%). Among the best performers in 2018: Paid Search (ad sales up +23% to reach $54bn) and Out-of-Home (+4.5% to $8 billion). This is partly due to the huge increase of ad spend from the technology sector. OOH is the only linear media type to experience consistent organic revenue growth. Ad sales grew by an average +4% per year in the last nine years, compared to -1% for all non-digital media sales (linear TV, print, radio, OOH) over the same period, according to a new report on global OOH advertising trends by MAGNA and RAPPORT (the OOH specialist agency of IPG Media brands).

One player showed record growth in both the supply side and the demand side of the ad market: Amazon more than doubled its advertising revenues in 2018, reaching an estimated $6 billion, based on financial reports, to emerge as a real competitor to Google; Amazon also increased its ad spending by +50% last year, to join the club of the ten largest advertisers (#6 behind P&G, ATT, Geico, Comcast and GM).

For 2019, MAGNA predicts ad revenues to grow for a tenth consecutive year (2010-2019) to reach $217 billion. The rate of growth will slow down, however, to just +1.9% (or +4.1% excluding cyclical events), as the economic environment starts to cool down. Real GDP will grow by +2.4% accord to the Philadelphia Fed, a decent performance, but a slowdown compared to 2018 (+2.9%).

Finance, Insurance, Pharmaceutical and Technology are the main drivers in terms of spending verticals. Within Technology, “FAANG” giants are ramping up their advertising budgets, esp. with linear media (television and OOH).

MAGNA expects more growth from the Technology sector in 2019: cloud services, smart home devices, the launch of 5G by wireless operators and the introduction of new subscription VOD services from Disney and Apple, are all expected to drive competition and ad spend. Many “Direct-to-Consumer” brands reached scale and started running branding campaigns in traditional media in 2018, in addition to digital media and eCommerce environments. They, too, will collectively contribute to ad spend growth in 2019. Pharma will remain a growth industry.

Finally, OOH will grow by +2.8% as new digital screens (Outfront Liveboard in New York, Pearl Media in the new Salesforces Transit Center in San Francisco, etc.) will again attract brands from sectors like Technology, Luxury and Travel.

According to Vincent Letting, EVP, Global Market Intelligence at MAGNA and author of the report: “One of the drivers of the historically long and historically strong era of growth the US market is experiencing, lies in the technology sector introducing mass consumer products and services. While doing so, internet giants ironically discover what CPG marketers knew all along: the power of traditional editorial media (television, out-of- home in particular) to build mass brand awareness.”

Next Forecast Update: June 2019.