Voice of Indian OOH industry

By M4G Bureau - August 25, 2023

An Outdoor Asia Indian OOH survey reveals interesting standpoints on matters critical to the industry’s growth prospects

Numbers don’t lie! In late July 2023, just before the Outdoor Advertising Convention 2023 was held in Delhi, Outdoor Asia conducted an industry survey to draw insights on the Indian OOH leadership outlook on factors that will determine the contours of an evolving OOH media owning landscape.

Method of study: The survey captured the inputs shared by heads of 33 media owning businesses operating across India. The inputs were shared in response to an online questionnaire, wherein the respondents selected from 3 options given under each question. In all, 10 questions have been addressed.

THE OUTCOMES

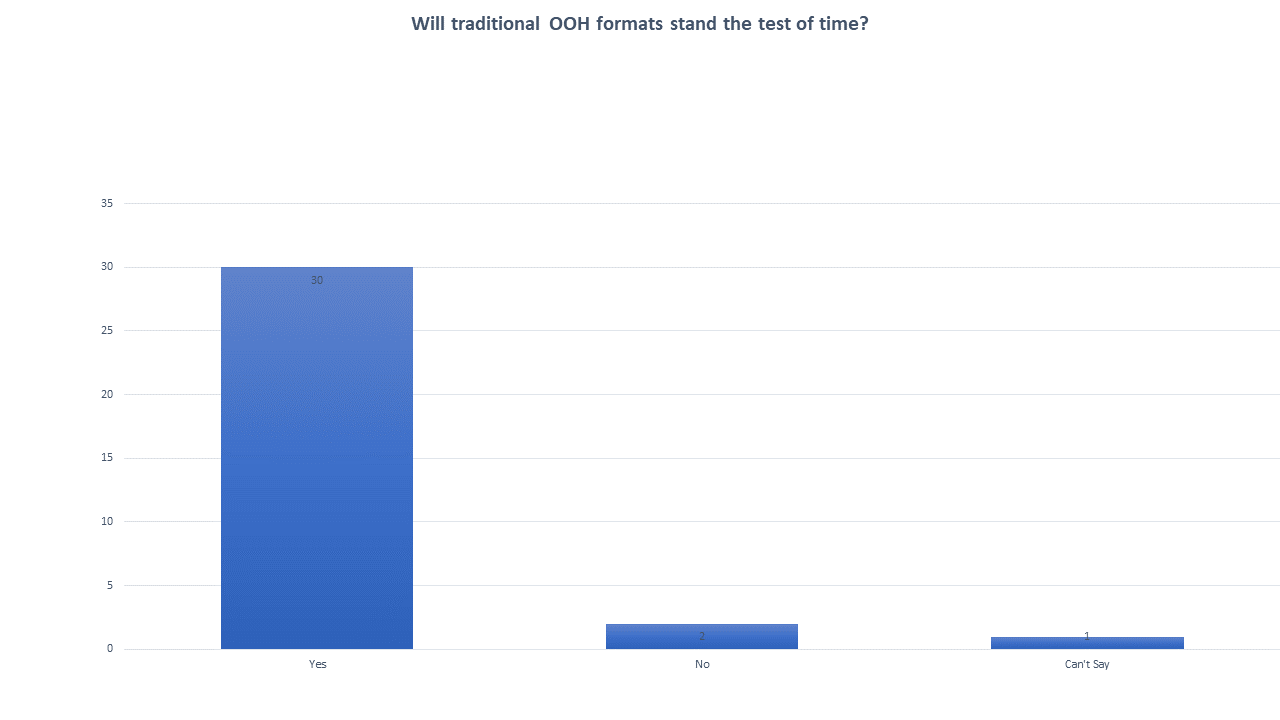

Q1. As new and innovative OOH formats are introduced, will traditional large format OOH like billboards and hoardings continue to attract advertising interest in the Indian markets over the next 4-5 years?

An overwhelming 91% of the respondents maintain that the traditional large formats will continue to attract advertising attention even as new OOH formats enter the fray. The classic media here to stay.

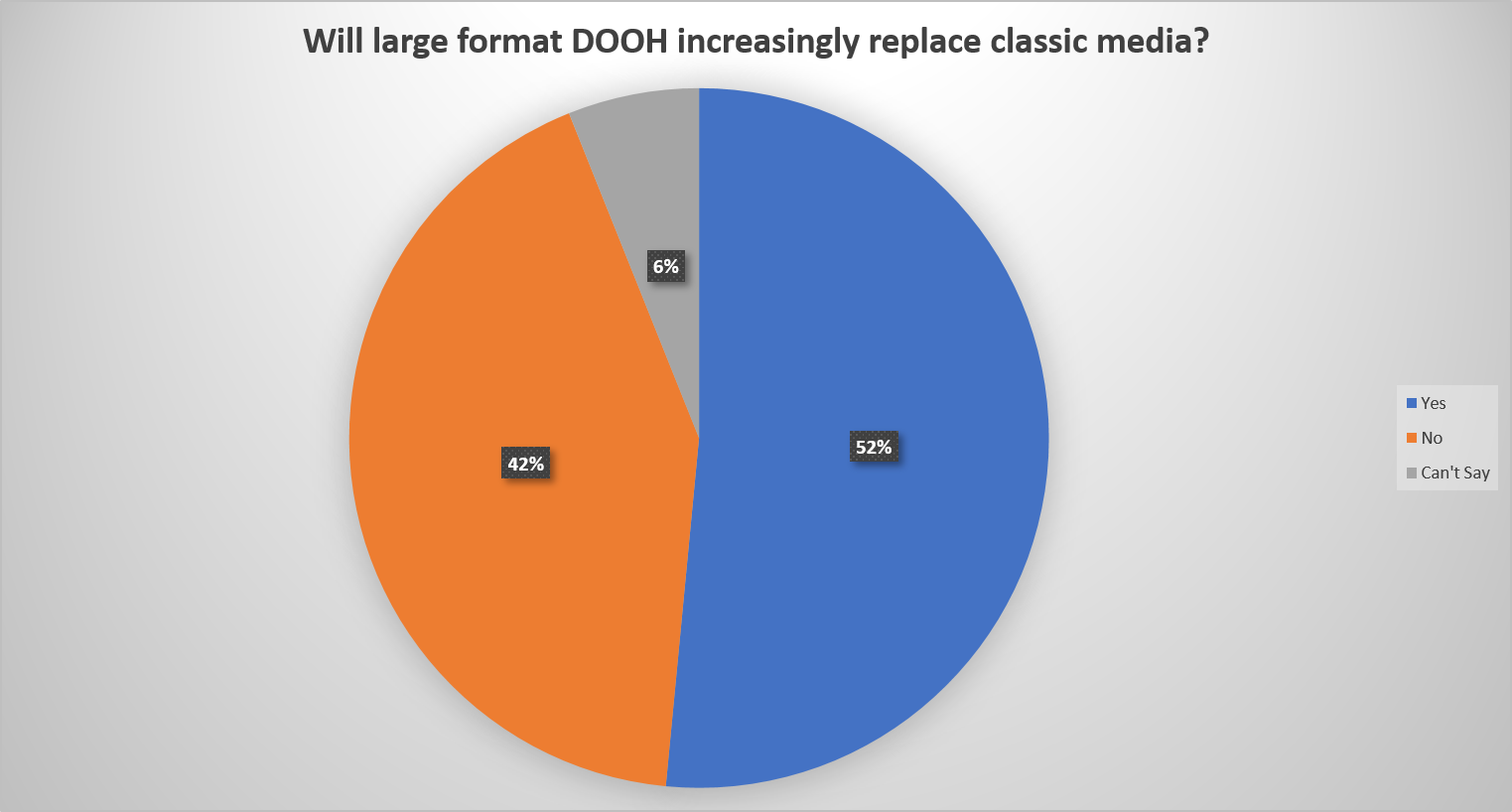

Q2. Will large format DOOH screens replace an increasing number of traditional large format OOH in the next 4-5 years?

In contrast to the overwhelming assertion that traditional formats will continue to be one of the mainstays of OOH business, 52% of the respondents in this case expected to see large format DOOH replacing an increasing number of traditional formats. Perhaps, the conclusion to be drawn is that while the number of traditional large format sites may reduce in due course of time, the importance of having the static media formats in the media mix will remain intact.

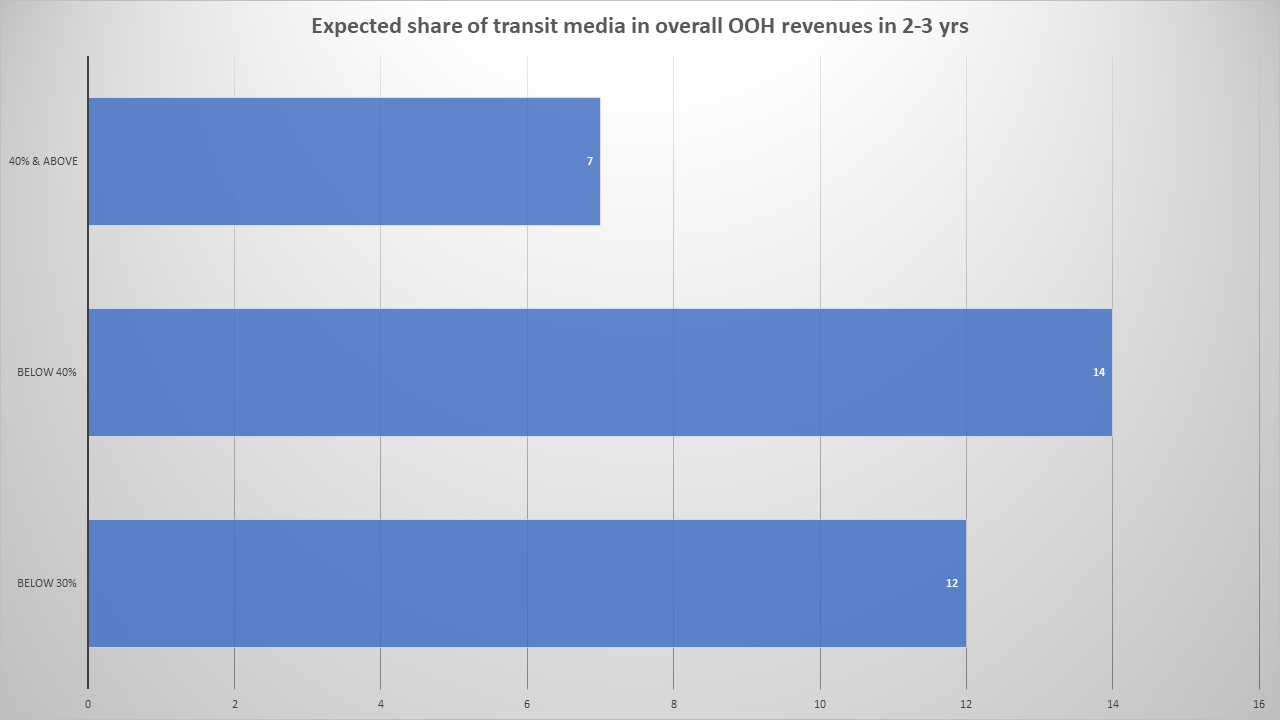

Q3. What is the expected percentage share of transit media in the overall OOH revenues in the next 2-3 years?

Certain estimates projected in the per-Covid year suggested that transit media was accounting for nearly 50% of overall OOH revenues in India. The pandemic brought down the share of transit media quite significantly but in the last 12 months all transit media segments like airport advertising to metro rail advertising had seen quite a rebound. However, in this survey only 21% of the respondents felt that transit media share of overall OOH revenues would exceed 40%. This could be indicative of the accelerated growth of other OOH segments.

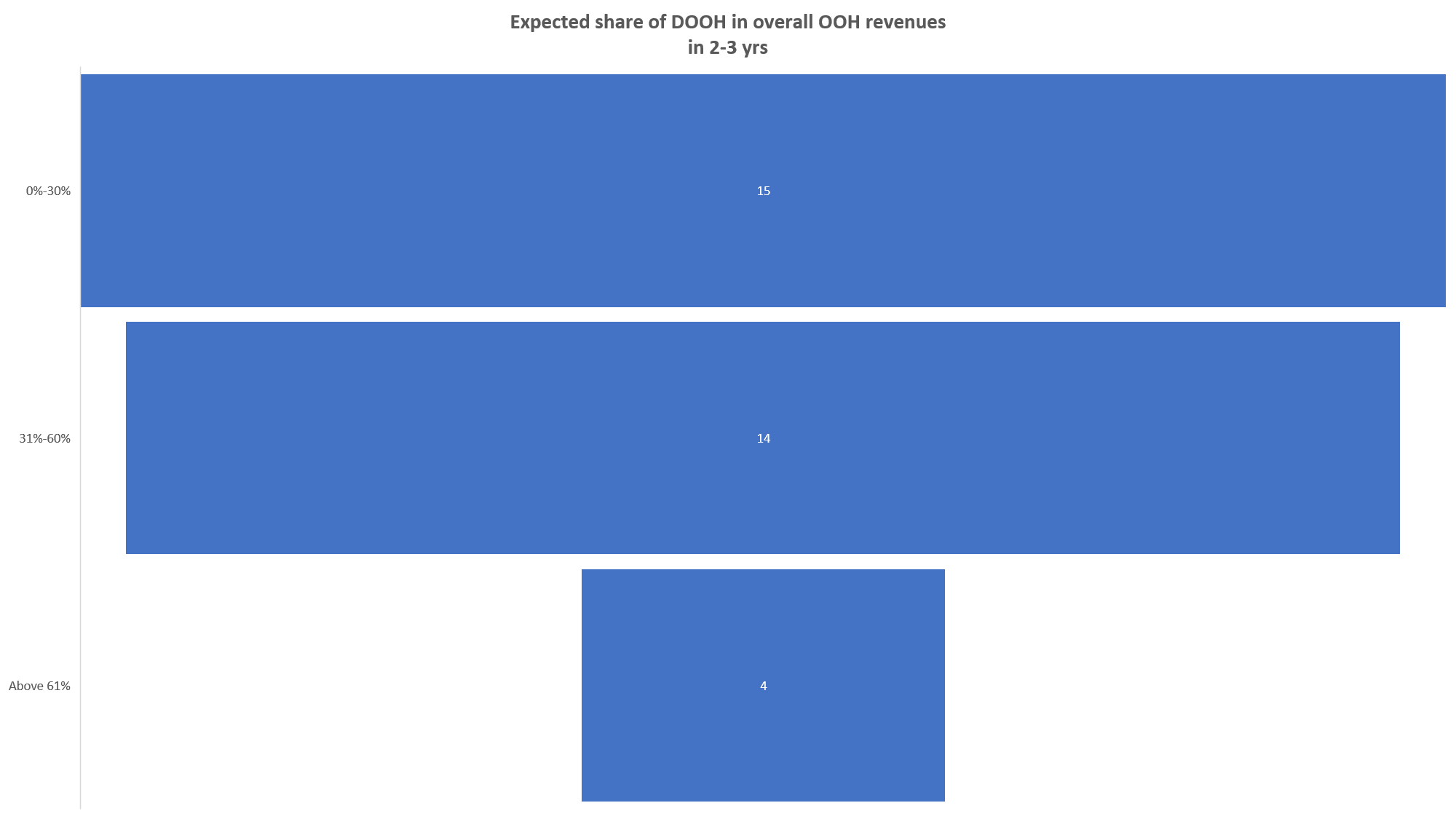

Q4. What will be the DOOH media share of total OOH revenues in controlled, indoor environments like airports, railway stations, metro rail stations, malls, cineplexes, etc. in the next 2-3 years?

The DOOH expansion in India is most evident in the controlled transit media environment and that perhaps explains why 42% of the respondents expect to see DOOH accounting for 31%-60% share of the total OOH revenues in the controlled environment.

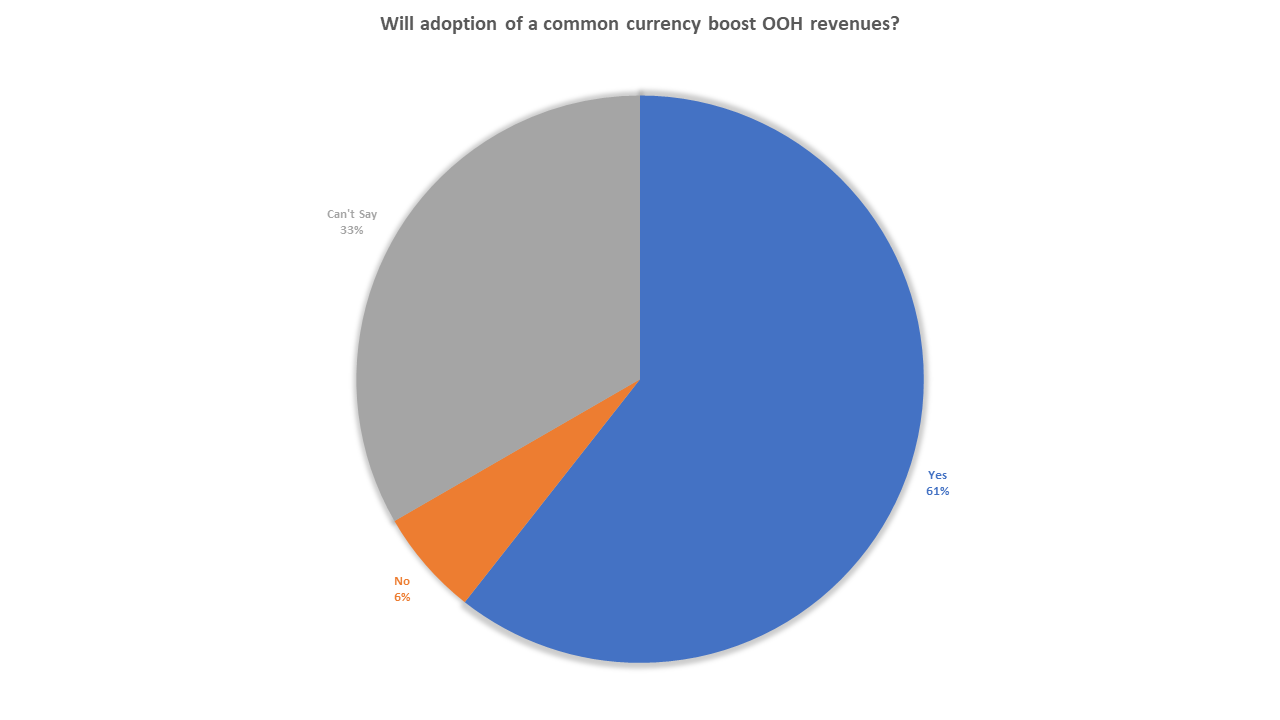

Q5. Will development and adoption of a common currency for audience metrics help Indian OOH double its share of the total ad pie in the next 4-5 years?

Indian OOH industry’s attempts at introducing a common currency for OOH audience metrics have to yield any concrete results. OOH media owning firms have hardly invested in any of the audience metrics that were brought into the market. However, in this survey 61% of the respondents see a positive outcome from the adoption of a common currency. Now, that’s music to the ears of adtech firms or those that are developed sophisticated audience metrics.

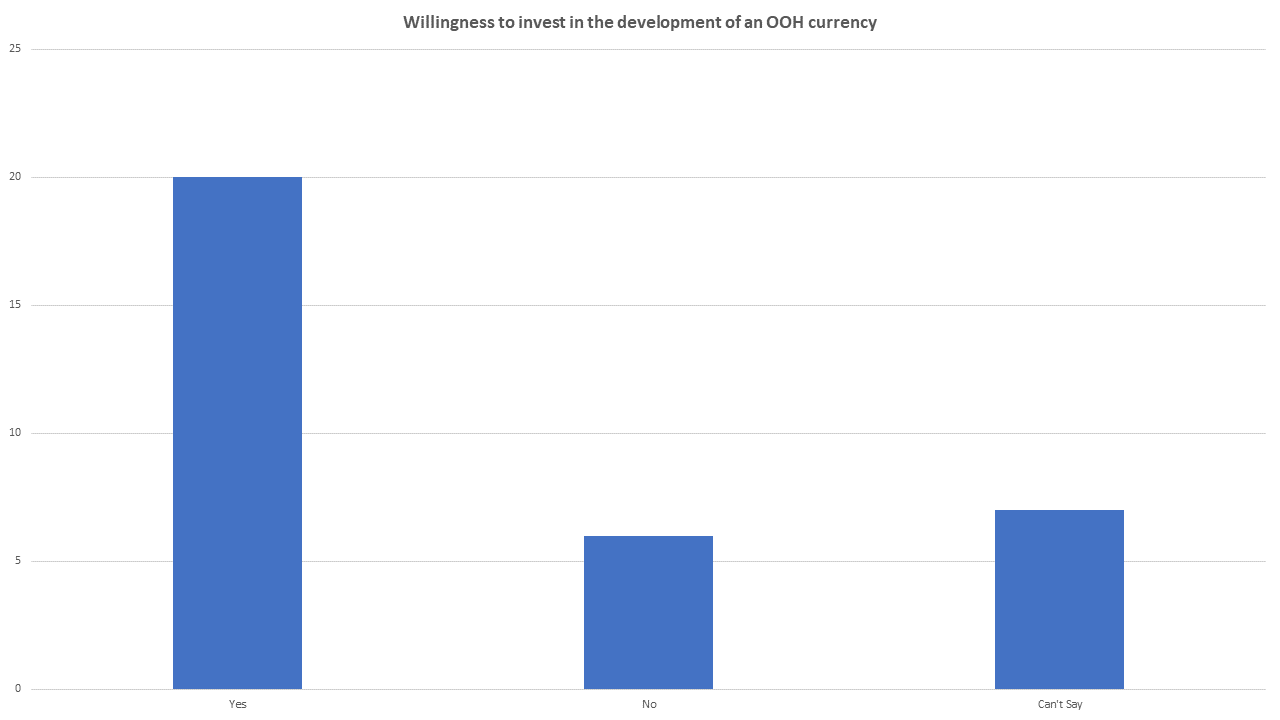

Q6. Is your firm willing to invest in the development of a common OOH audience measurement tool?

Following from responses to the previous question, nearly 61% have maintained that they would invest in the development of an OOH currency.

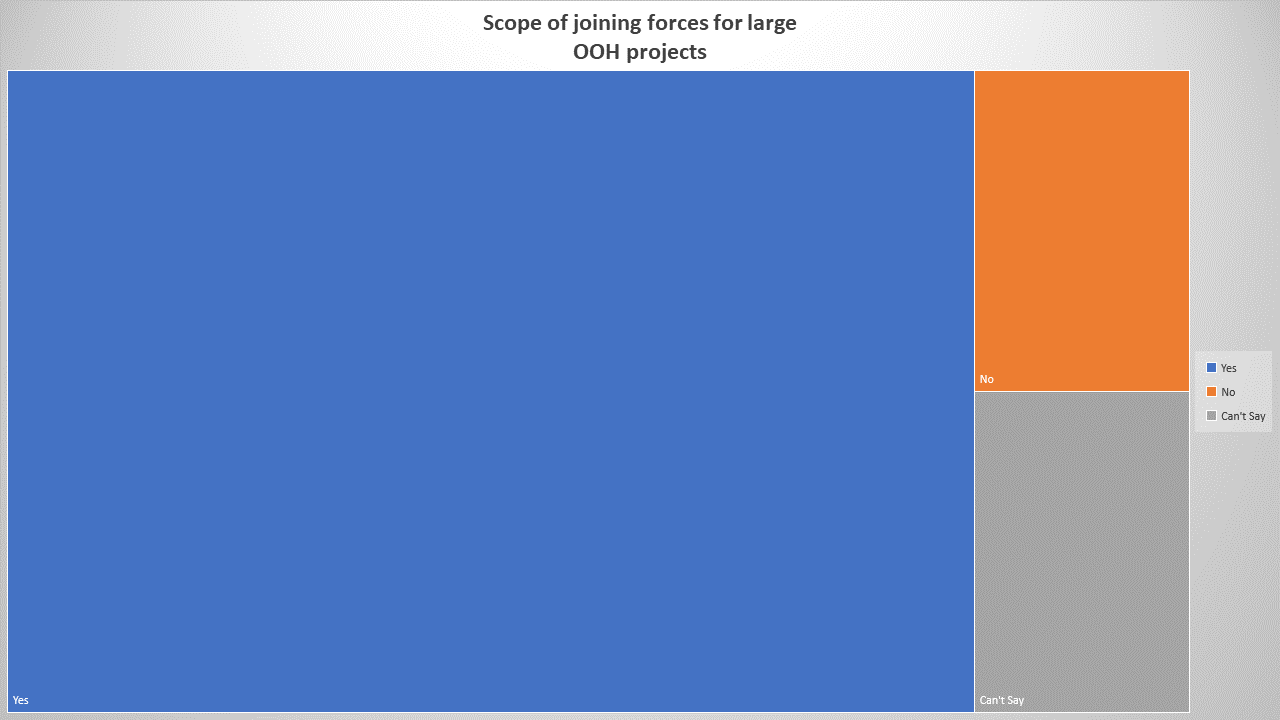

Q7. Is there scope for OOH media owners to pitch for large projects in railways, smart cities, etc., in consortia?

Fragmentation of OOH media ownership was one key factor limiting the growth of the industry in India. While consolidation of businesses is not likely to come about in the medium term, a collaborative approach by the media owners would greatly augment the industry’s capability to take up large projects. In this survey, a large majority of the respondents have said ‘yes’ to the scope of concerted efforts to pitch for large projects.

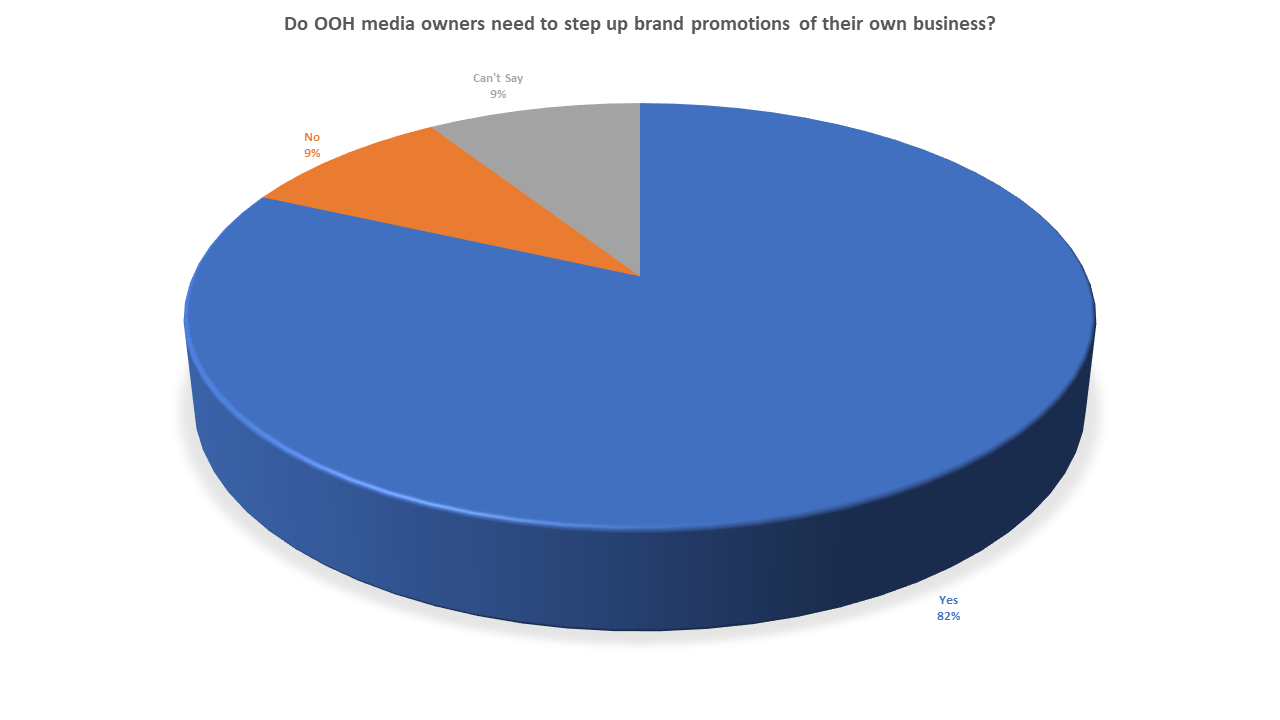

Q8. Should media owners invest more in their own branding and marketing initiatives for an image makeover of the business and to attract relevant talent to their enterprises and OOH industry?

Creating strong OOH brands is a bulwark against commoditisation of this medium. 82% of the media owners participating in this survey have accepted that brand promotion is necessary for their media owning enterprises.

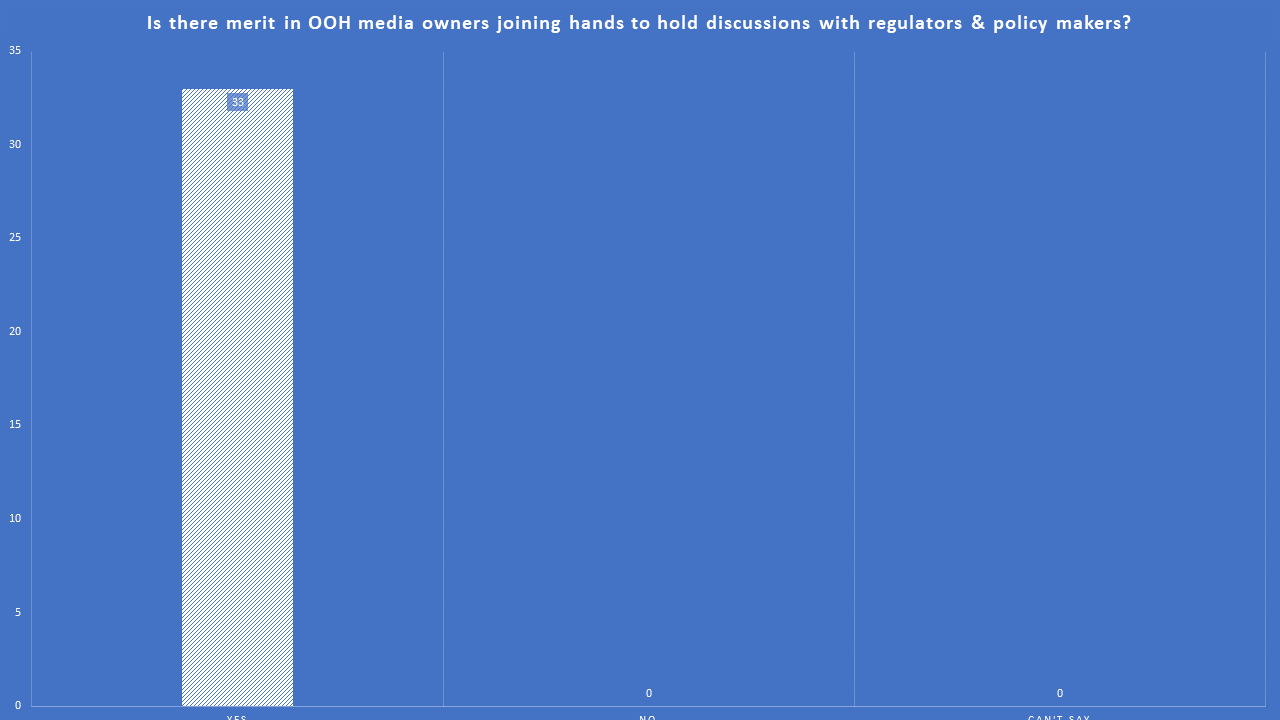

Q9. Should media owners come together in a joint initiative to hold dialogues with government and municipal bodies to create common OOH advertising standards?

While a large majority of the respondents were in favour of undertaking joint initiatives to pitch for large projects, 100% of the respondents have felt that joint industry efforts are required to conduct discussions and dialogue with the regulators and policy makers. If so, what has stopped the media owners from joining hands for this cause?

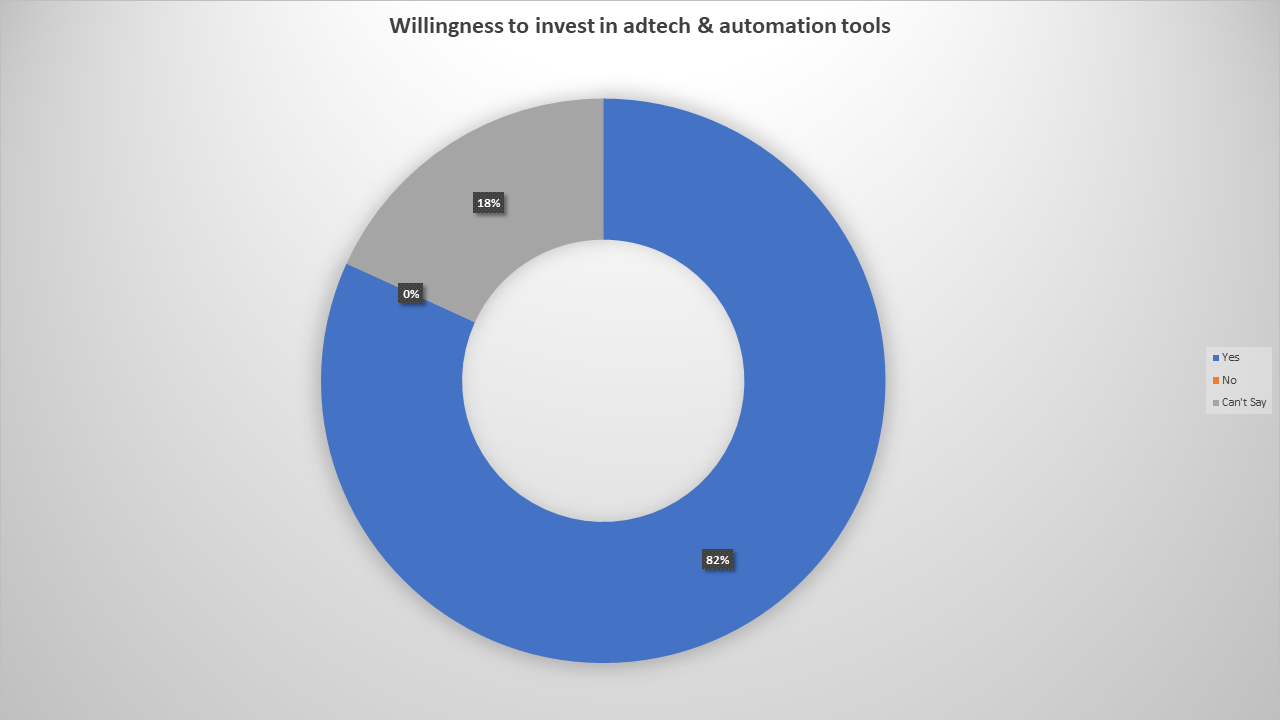

Q10. As a media owning firm, are you open to investing in adtech and automation tools and platforms?

Who can stop the march of technology? Indian OOH recognises the importance of widescale adoption of adtech and automation tools. It’s just a matter of time before the industry undergoes a tech upheaval.