‘Global OOH market is set to back bounce in 2021’ says PWC Global report

By M4G Bureau - November 20, 2020

DOOH technologies will play a central role in quantifying advertisers’ return on investment as they are turning away from traditionally preferred channels such as cinema or OOH advertising, hit hard by Covid19

PWC Global has launched Global Entertainment & Media Outlook 2020-2024 report on the theme ‘Pulling the future forward: The entertainment and media industry reconfigures amid recovery’.

This year’s outlook takes into account the effects of Covid19 on the entertainment and media industry. The report showcases five-year projection of consumer and advertiser spending data across 14 segments and 53 territories.

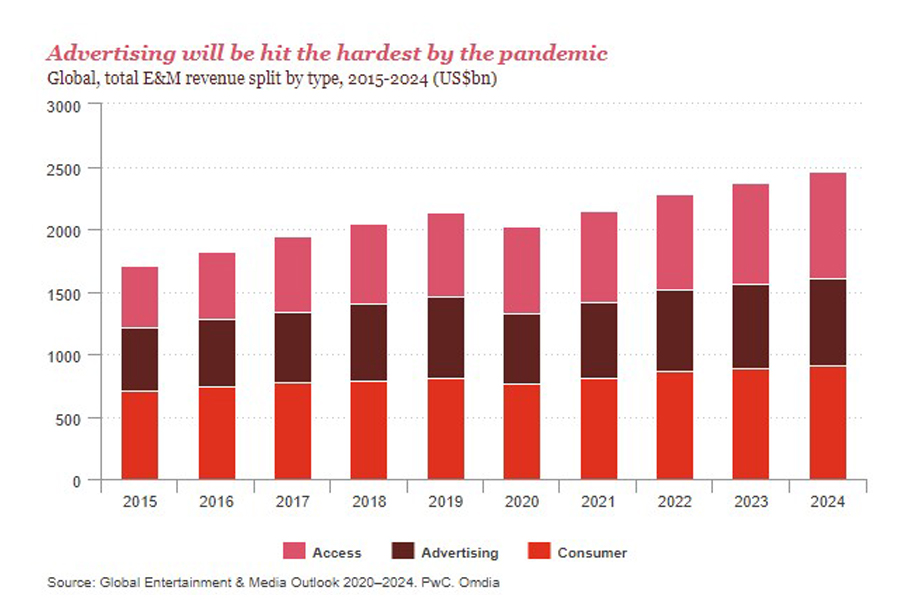

The projection say that the global entertainment and media revenue is set to fall nearly 6%, or more than US$120 billion, after a solid 4.7% year-on-year growth in 2019. Advertising will be the slowest segment to recover and is not expected to exceed 2019 figures until 2022, although internet advertising has emerged relatively unscathed as compared to print. Some advertisers are turning away from traditionally preferred channels hit hard by pandemic disruption - such as cinema or out-of-home (OOH) advertising - to podcasts, which are proving resilient.

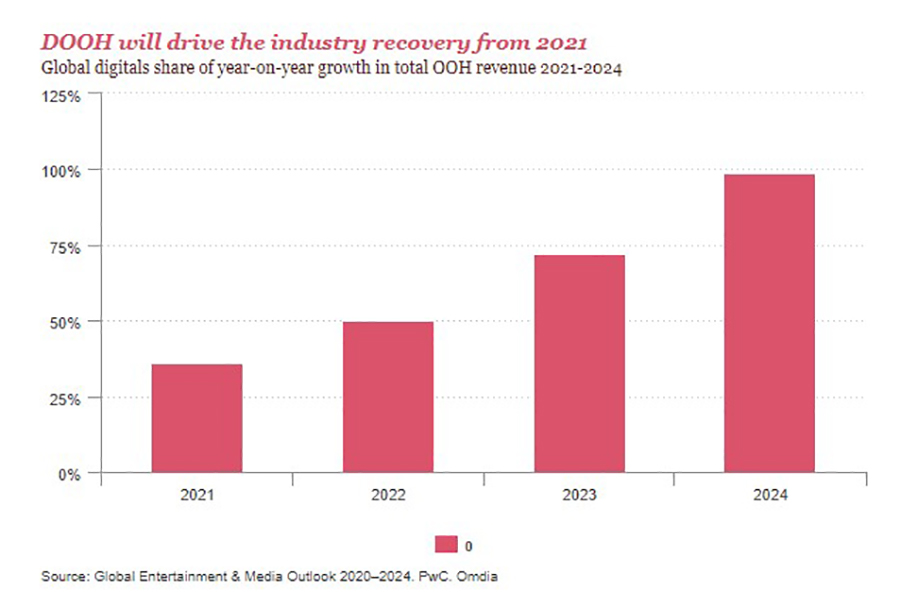

The report says that the global out-of-home (OOH) market will see severe impact from the pandemic in 2020, but the sector is resilient and is set to bounce back in 2021. Overall, the sector is experiencing a shift as digital OOH (DOOH) enters the mainstream and drives profound change, and will also drive the industry’s recovery from 2021. As DOOH increases in importance relative to the overall performance of the OOH market, the twin levers of construction and infrastructure spending will exert even more influence. Markets without major construction projects to create new inventory or with projects called off or on hold due to worldwide contraction due to the pandemic - can leverage DOOH to grow revenue, but only at the expense of retrofitting existing displays and cannibalising physical OOH revenue.

According to the report, as consumers exercise more control than ever over personal media preferences, advertisers continue to gravitate to OOH, which cannot be blocked or skipped. However, the growth of home working and online shopping, with consumers spending more time indoors in the wake of the pandemic, could erode the importance of OOH.

DOOH technologies will play a central role in quantifying advertisers’ return on investment, leveraging tools such as display-mounted cameras and AI analysis to determine audience composition and more precisely target OOH ads, the report says.

OOH remains largely immune to changing consumer behaviour, resulting in a market that continues to be remarkably stable, with 49 of 53 global markets showing growth in 2019. That pattern is expected to hold over the forecast period, with 50 of 53 expected to register growth, including every market outside the Middle East North Africa (MENA) region, as per the report.