Ad Policies & Regulations

Monopoly fears rise as BBMP pushes new Outdoor Ad policy

As outdoor ads return to Bengaluru after a seven-year ban, BBMP’s new policy is being called unrealistic, monopolistic, and seems to be heading straight for litigation.

The Bruhat Bengaluru Mahanagara Palike (BBMP) has introduced a new outdoor advertisement policy that it believes will streamline the sector and boost civic revenues. However, industry stakeholders argue that the framework is unrealistic, could create monopolistic control, and may get stuck in the same cycle of litigation that has dogged BBMP’s advertising initiatives for decades.

Although the civic body has set ambitious revenue targets, the muted response to its fresh tenders tells a different story. With the August 25 deadline approaching, only two applicants have come forward so far, suggesting that most of the industry is unconvinced about the viability of the model.

A question of viability

According to media owners, the new policy has been in discussion for over two years, but feedback from the industry has largely been ignored. Manmohan Singh, Head of the Bangalore Outdoor Media Owners Association, one of the bidders who has applied despite misgivings, said the model makes little financial sense.

“From the very beginning we have been pointing out that this structure is not viable,” he said. The policy requires operators to secure permissions, negotiate with landlords, and pay significant fees to BBMP, all while competing within rigidly defined zones. The costs of compliance, combined with the already high rents for prime outdoor sites, make it difficult for most operators to see a path to profitability.

He added that BBMP’s expectation of raising thousands of crores in revenue from this system was unrealistic. “They are asking for amounts that don’t match the size of the industry itself,” Manmohan pointed out, noting that the previous tender round had also failed to attract serious participation.

The documentation burden

A central condition in the new framework is that operators must obtain no-objection certificates (NOCs) for their legacy holdings. While this may appear like a standard compliance requirement, those in the industry say it is practically impossible to fulfil.

Bengaluru’s outdoor advertising was under a blanket ban for nearly seven years. During this time, no sites could operate legally, and paperwork related to permissions and payments inevitably lapsed. Expecting media owners to now produce uninterrupted documentation covering 10 to 15 years is seen as unreasonable, specially since BBMP itself does not possess a complete archive of its own records.

“Even senior officials admit the files don’t exist in full. If the system itself lacks records, how can operators be penalized for not producing them?” Manmohan asked. The compliance burden, he argued, has been designed in a way that most will struggle to clear, not because they were non-compliant, but because the industry was inactive for years.

This, he said, creates a situation where only a handful of players with the resources and influence to navigate these gaps may survive, further narrowing the market.

Monopoly concerns and landlord rights

The city has been divided into eight advertising zones under the new scheme, with a cap of four zones per operator. On paper, this appears to prevent monopoly. In practice, however, critics argue it consolidates too much power in too few hands.

Manmohan explained that the model disrupts landlord rights: “If BBMP allocates a zone to one player, then every landlord in that area is left with no choice but to deal with that operator. It takes away the property owner’s fundamental right to decide who to lease space to.”

The implication is that even landlords willing to partner with smaller or local operators will be locked out, creating a highly centralised and restricted market. This concentration of control, industry voices argue, is against the very spirit of fair competition.

Litigation almost inevitable

The outdoor advertising sector in Bengaluru has long been marked by litigation. In the past 25 years, nearly every major BBMP advertising tender has ended up in court, often stalled for years under stay orders.

Stakeholders warn that this policy will be no different. “If disputes arise and given the ambiguity over documentation and the monopoly-like structure, they almost certainly will, operators will still have to honor their financial commitments to landlords while being unable to earn revenue,” Manmohan said.

He pointed out that BBMP, unlike private landlords, is not financially exposed when cases drag on in court. “This leaves us carrying all the risk while the civic body remains insulated.”

Revenue targets out of sync with reality

Perhaps the sharpest criticism is reserved for BBMP’s revenue projections. An anonymous media owner described the expectations as completely detached from the size of the industry.

“The idea that BBMP can earn ₹500 crore annually from this is absurd,” he said. “If we are forced to pay such amounts to the corporation, landlords will demand a similar share. Add in the cost of building structures and our capital expenditure shoots up massively. By the time agencies add their margins and brands are billed, the numbers are out of reach for the market. The entire Indian outdoor industry isn’t as large as what BBMP is expecting from one city.”

An uncertain future

BBMP sees the new policy as a route to regulation and revenue. For operators, however, it looks like an arrangement built on fragile assumptions: incomplete records, heavy compliance, high costs, and concentrated control.

With only two bidders so far, the gap between the civic body’s expectations and the industry’s confidence is already stark. Whether the policy can avoid the pitfalls of litigation and monopoly,or whether it becomes another stalled experiment in Bengaluru’s long troubled outdoor advertising history, remains to be seen.

-

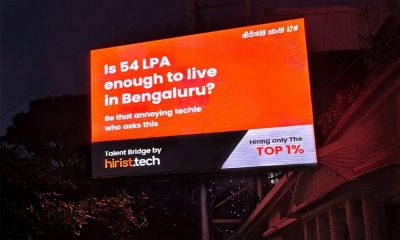

Campaigns

CampaignsMcDonald’s Germany’s thoughtful DOOH campaign for Ramadan

-

Tenders

TendersUPMRC invites bids for advertising rights across 15 Kanpur metro stations

-

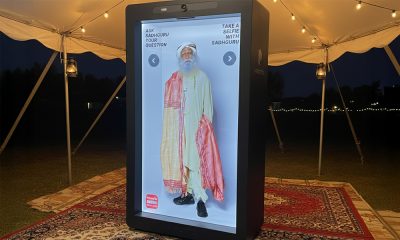

Campaigns

CampaignsInteractive AI hologram takes a spiritual avatar

-

Tenders

TendersSignpost India bags exclusive advertising rights for “Kolkata Streetscape Renaissance” project