Indian OOH Adex at Rs 4,140cr in 2023, records 13% YoY growth vs 10% overall Adex growth: Pitch Madison Ad Report 2024

By M4G Bureau - February 16, 2024

In 2024, Indian Adex to grow by 12% and cross Rs. 1.11 lakh crore

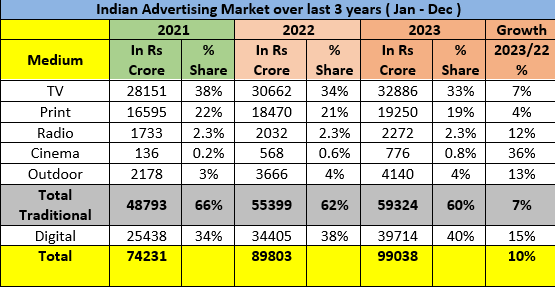

OOH Adex in India has recorded a remarkable 13% growth YoY in 2023, while maintaining its overall share of the Adex at 4%. The total OOH ad spend breached the Rs 4,000 crore level to reach Rs 4,140 crore, which is nearly double that of Rs 2,178 crore recorded in 2021. These findings come from the Pitch Madison Advertising Report 2024 that was released in Mumbai on February 15.

Overall, in 2023 total Adex grew by just 10%, lower than the projected 16% growth. Traditional Adex grew by 7% and Digital Adex by 15%. A media release issued after the release of the report cites that “increase in raw material prices in H1, continuing wars in Russia/Ukraine and Israel/Hamas, inflation, funding winter within the start-up industry are some of the factors that have contributed to the slow growth rate. Whilst the GDP growth is estimated at 7.3%, if you look deeper, the contribution of private final consumption expenditure component of GDP has come down, which may explain the reason for lower buying of products and services by the middle class and rural India.”

It was also cited that compared to Indian Adex growth rate of 10%, Global Adex, according to WARC, grew by just 5% in 2023. Brazil and India are now the two fastest growing Adex markets.

The report shows that FMCG continues to be the largest category contributor in Adex and has gained share of 1% point to 33% in 2023. However, real estate emerged as the largest category in both OOH and Radio, pipping FMCG.

Overall, ecommerce as a category established itself as the 2nd biggest contributor to Adex, with a Share of 11% in 2023.

There was no change in the Top 3 Advertisers of Adex - HUL, Reckitt and RIL. Godrej Consumer Products is the new entrant in the Top 5 list, having moved up in rank from 12 to 5. The Top 50 Advertisers list has 20 FMCG companies and only 1 Start-up in the list, compared to 9 last year, reconfirming the funding winter in the start-up eco system. Whilst total Adex has grown by 10%, the advertising budgets of the Top 10 advertisers had grown 20%.

Pertinent to add that although Cinema registered the highest growth of 36%, to reach Rs. 776 crore, but it has yet not reached its pre-Covid levels; its share has marginally gone up from 0.60% to 0.80%.

At an event organised on the occasion of the report release, Shantanu Khosla, Executive Vice Chairman – Crompton Greaves Consumer Electricals, who was the Chief Guest said, “India is an underpenetrated, underserved country and that the pie is going to increase, but it is imperative for brands to be authentic, build trust and have a sense of purpose”. He further added on, “Creative/Content will always be more important than media”.

Sharing the highlights of the Report, Sam Balsara, Chairman – Madison World said, “Whilst the Outlook for Adex in India is extremely strong in the mid-term and long-term, in the short term we are witnessing a slowdown in momentum because of India Inc’s focus on quarterly profits. This does not augur well for sustained growth in profits for Advertisers who should be focussing on volume growth.”