‘OOH advertisers are growing in number’

By Rajiv Raghunath - January 05, 2024

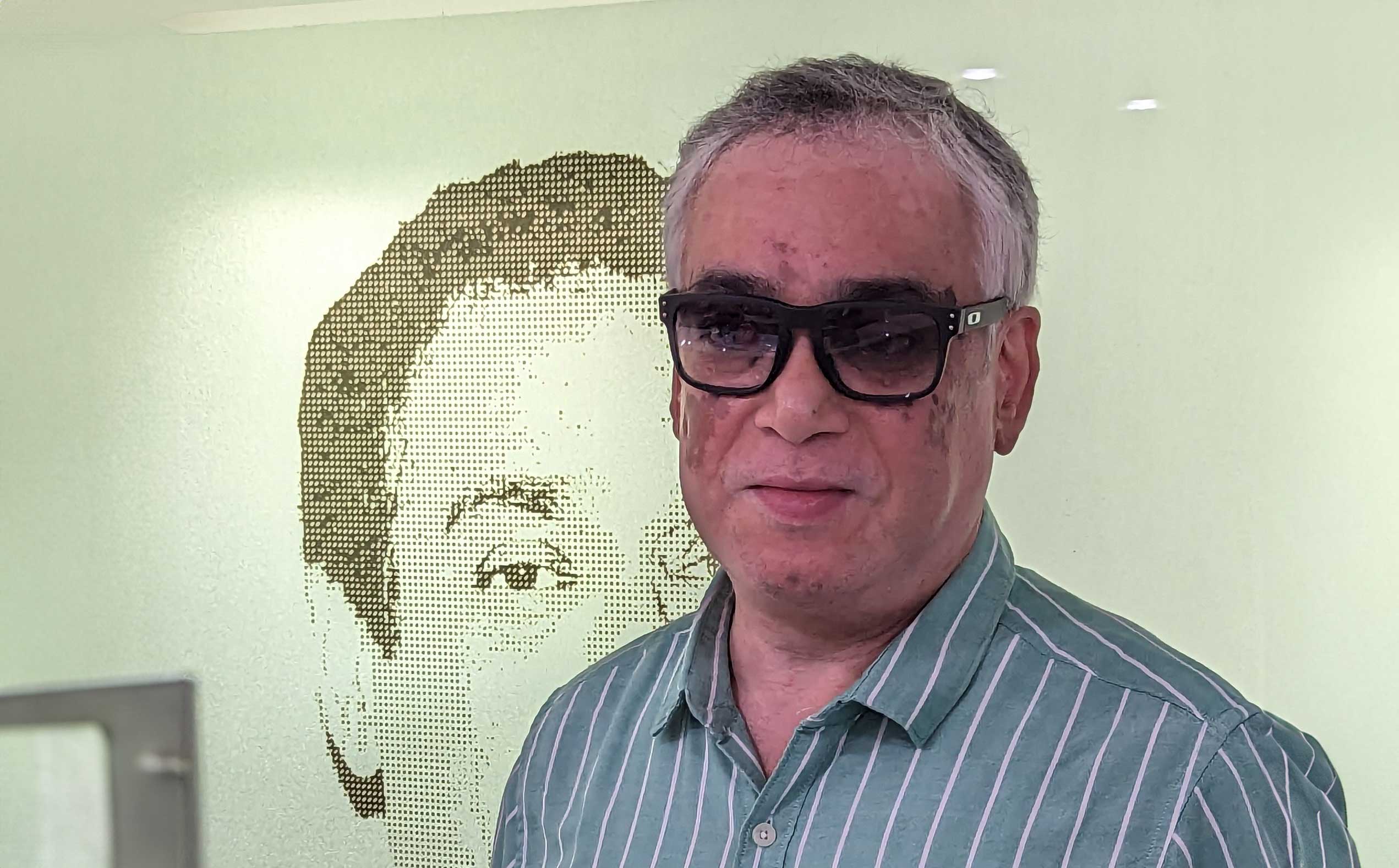

Abhijit Sengupta, CEO, OAP also underlines the imperative of balancing media supply with demand

Year 2023 was a period of consolidation for Indian OOH. Sharing his perspectives on the key business trends observed during the year, Abhijit Sengupta, CEO, OAP says that during the Covid impacted period in the absence of any traditional media advertisers experimented with digital much more. “Am sure they tasted some successes but most importantly they managed to figure out how much to spend and how to spend, basis outcomes in numbers. That’s why as an industry it has become imperative to get back the respect by providing ROIs. Advertisers are really bothered on how much money is going waste,” he says.

During 2023, OOH media owners became increasingly bullish, especially in Mumbai. “Look at the number of conversions happening from static or classic to digital. It is a serious capex coming in. But we need to be a bit cautious, the supply and demand should be well balanced. Overall numbers need to be under control whether it is DOOH or Classic OOH or both,” says Abhijit.

In his view, “There has been a subtle change in the way OOH is planned and used these days. It has moved from Recency to Adstock model, which means shorter duration of campaigns with higher Reach with less focus on Frequency. It does put a lot of pressure on media owners in managing inventory i.e. minimising interim vacancy, but the positive outcome has been that now we have lot many OOH users than pre-pandemic.”

In terms of YoY growth, OAP grew by 38% in topline from Rs 267.98 crore in 2021-2022 to Rs 370.13 crore in 2022-2023, he states, while adding that “with our sub-brands we managed Rs 394 crore. The spike was primarily due to the slow start in 2021-22.”

At the industry level, “As per FICCI our industry grew from Rs 3,700 crore in 2022 to Rs 4,100 crore in 2023, that’s barely 11% and I don’t think is providing the right picture. For three reasons: (a) most OOH agencies are part of a network, they do not report their individual financial numbers in ROC and (b) OOH in Tier 2 towns or below are bought directly from Media Owners, and (c) OOH is not just billboard and bus shelter, there’s a lot more in non-roadside. And how much of them gets recorded, I have my doubts.”

Abhijit cited five brand categories as most active in OOH in 2023 -- Real Estate, OTT and Mobile Handset followed by Automobile, BFSI and FMCG in equal measure.

On DOOH & business growth, Abhijit comments that “location is the most important aspect. If the brand’s need and its TG is catered to by certain locations, then we will go for it, irrespective of whether it is DOOH, classic or ambient. Controlling wastage is our primary focus.”

Looking ahead, he says: “Post pandemic we had picked up many tiny and low return businesses to survive and revive cash-flow. But that is not the focus anymore. We are now clearly focussed on the bottom line, that we intend to grow by 50%+”.