Industry News

OOH Advertising segment to reach INR 7,900 crore by 2027, says EY Report

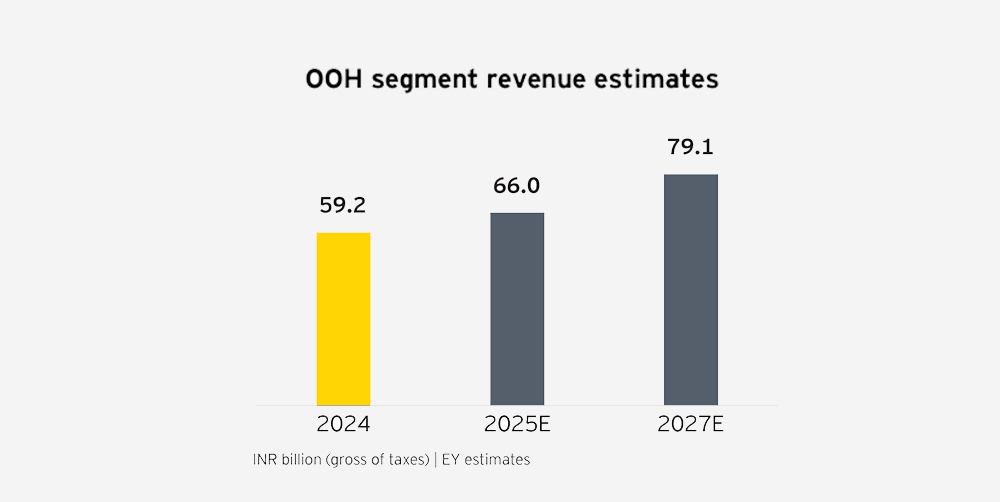

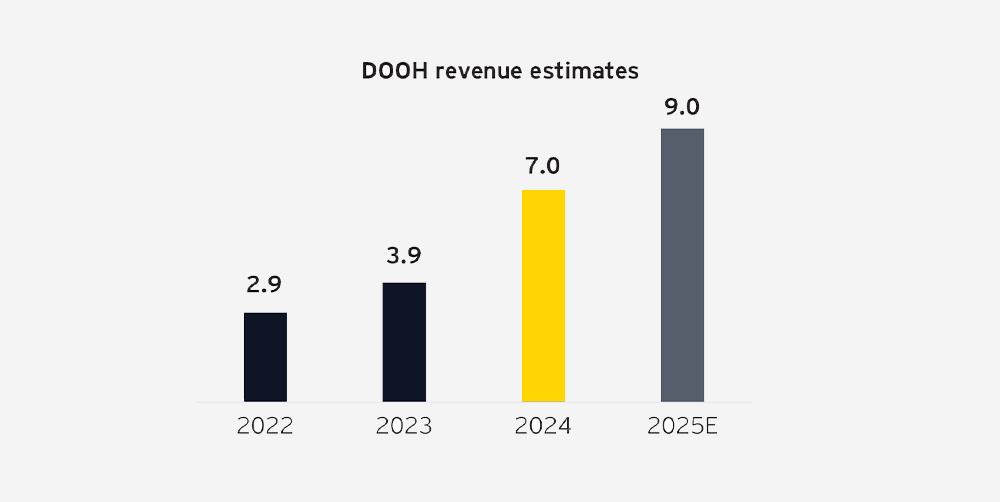

A recent report by EY analyzing the Indian Out-of-Home (OOH) advertising sector says the share of Digital OOH (DOOH) out of the total OOH revenues is expected to grow from the current 12% to 17% by 2027, with a CAGR of 24%.

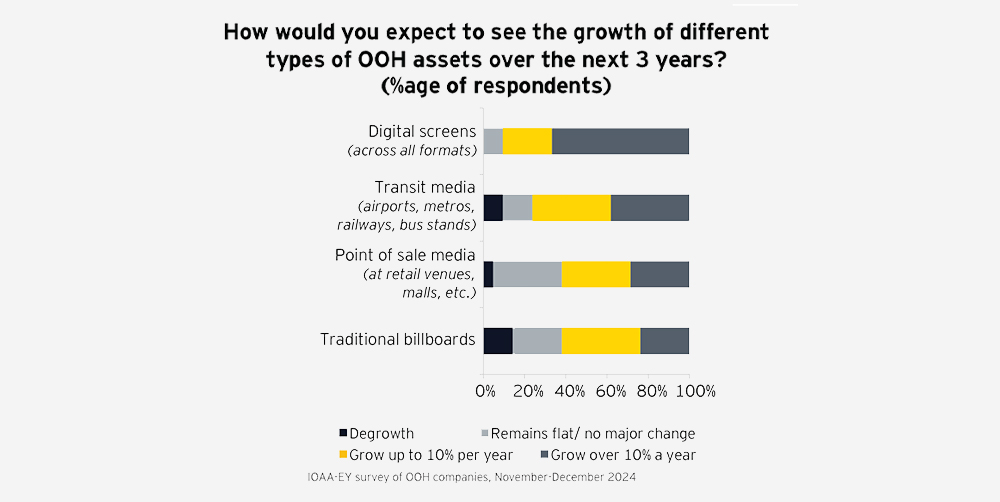

The EY report offers a comprehensive overview of the sector’s performance, key trends, and future projections, highlighting significant revenue growth and the increasing prominence of digital and transit OOH. According to the report’s findings, the Indian OOH segment achieved an all-time high in revenue in 2024, with projections indicating continued strong growth in the coming years.

Overall OOH growth

India’s OOH segment grew by 10% in 2024, reaching INR 5,920 crore. This growth encompasses traditional, transit, and digital media. The growth is attributed to OOH’s ability to reach affluent audiences, increasing urbanization, the expansion of transit media, and the availability of premium digital ad inventory.

Traditional OOH

Traditional OOH media, including billboards and gantries, grew by 12% in 2024. This growth was fueled by significant election spending and continued investment from key sectors like real estate, education, organized retail, consumer services, and FMCG. Traditional formats remain popular due to their high visibility and permanence.

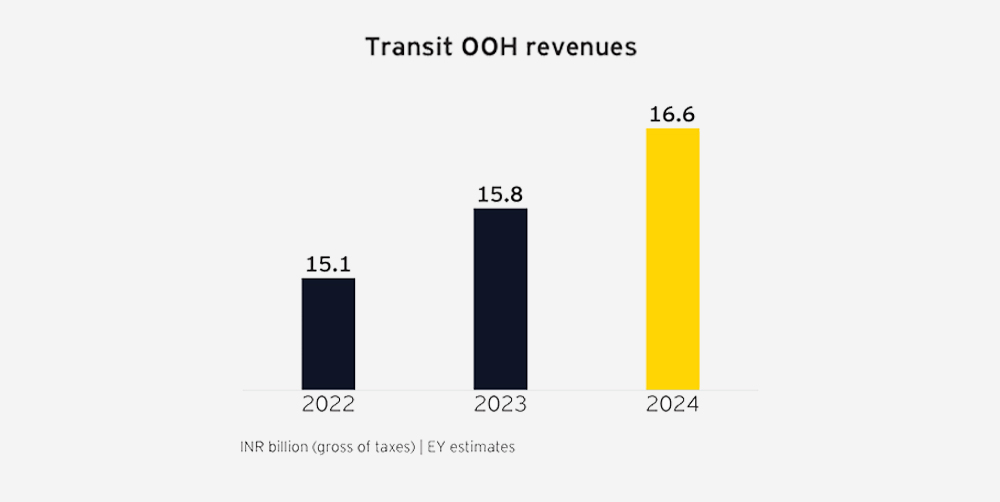

Transit Media on the rise

Transit media continues to be a strong growth driver within the OOH sector. This segment has benefited from India’s investment in airports, railway stations, metro lines, and bus stands. Transit media now accounts for 28% of the total OOH segment revenues. Airports remain the dominant segment within transit media, contributing over 50% of transit revenues, while rail and metro are also growing.

DOOH expansion

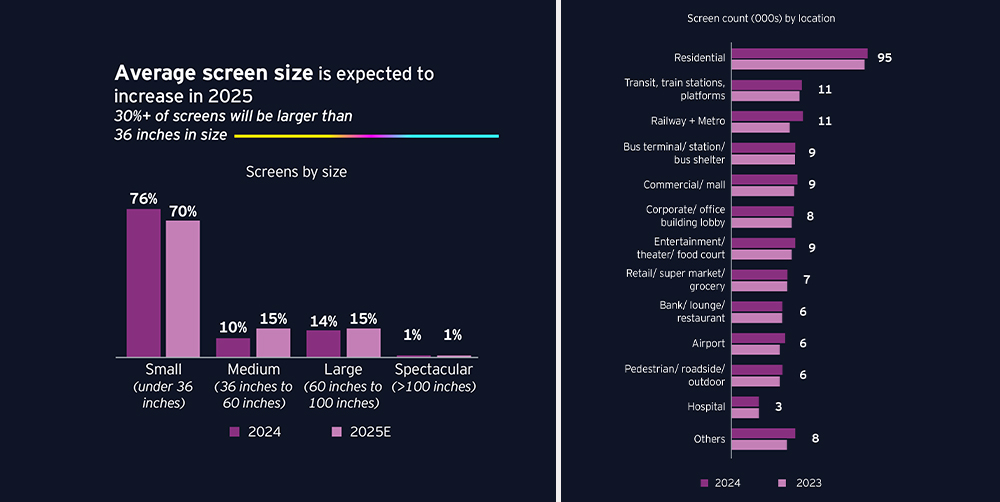

Digital Out-of-Home (DOOH) is a key contributor to the sector’s growth. DOOH revenues reached INR 700 crore in 2024. DOOH assets are expanding across both traditional and transit media and now contribute about 12% of total OOH revenues. There are approximately 185,000 active DOOH screens in around 50 cities in India, with about 15% being large-format premium screens. While currently concentrated in major metros, DOOH expansion is expected to broaden, creating a powerful national network.

Future projections

The OOH segment is projected to reach INR 7,900 crore by 2027. This growth will be driven by digital and premium assets. DOOH is expected to increase its share of total OOH segment revenues to 17% by 2027, with a CAGR of 24%. Transit OOH is projected to grow at 16% annually until 2027, while traditional OOH is expected to grow at 8%, driven by geographic diversification.

Key trends and developments

- DOOH and social media integration: There’s an expectation that DOOH spending will increasingly come from digital ad budgets, and technology will enable smaller advertisers to buy DOOH inventory alongside search and social.

- Creative evolution: OOH is expected to see more creative agencies develop OOH-first campaigns that integrate OOH with physical and digital elements.

- Measurement standardization: The Roadstar platform, launched by the IOAA, aims to provide standardized measurement of OOH viewership using satellite and mobile data.

- Experiential OOH: OOH marketing is evolving to include immersive experiences with interactive kiosks, AR/VR, and gamification.

- Sustainability focus: There’s a growing emphasis on eco-friendly practices in OOH, including energy-efficient digital screens, renewable energy use, and recyclable materials.

- E-commerce integration: OOH is expected to incorporate performance advertising, using geo-location data for targeted offers.

Challenges and concerns

Despite the growth, the report highlights challenges:

- Inconsistent regulations: Inconsistent municipal regulations and non-standard government permissions create operational complexities.

- Fragmented asset ownership: Fragmented asset ownership leads to unorganized players, hindering the development of scaled national OOH offerings.

- Talent quality: The OOH segment needs to improve the quality of its talent through training and repositioning.

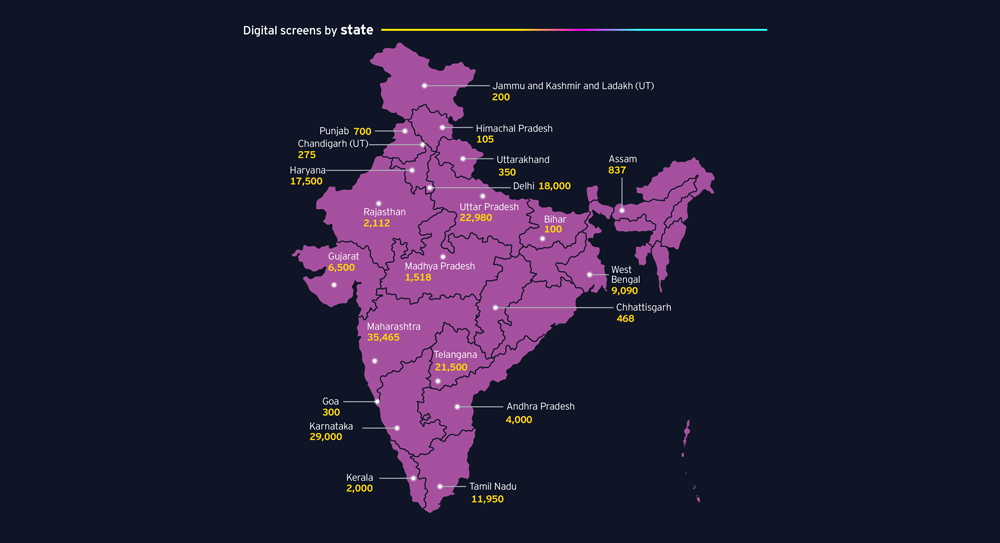

Digital screen growth and state-wise distribution

The number of digital screens in India has been increasing significantly. There were 185,000 digital screens in India in 2024, with a 12% increase over 2023. 70% of these screens are in transit and residential locations, and 75% are located in the top 12 metro cities. The average screen size is expected to increase in 2025, with a larger share of screens being over 36 inches.

The EY report provides the following data on digital screen size variation and its projected growth:

2023:

- Under 36 inches: 65%

- 36-60 inches: 20%

- 60-100 inches: 10%

- Over 100 inches: 5%

2025 (Projected):

- Under 36 inches: 40%

- 36-60 inches: 30%

- 60-100 inches: 20%

- Over 100 inches: 10%This data indicates a clear trend towards larger screen sizes in the DOOH segment.

Breakdown of digital screens by state:

- Maharashtra leads with 35,465 screens, followed by Karnataka (29,000), Uttar Pradesh (22,980), and Telangana (21,500).

- Delhi has 18,000 screens, and Haryana has 17,500

- Tamil Nadu has 11,950 screens, and West Bengal has 9,090.

- Gujarat has 6,500 screens, and Andhra Pradesh has 4,000

- Kerala has 2,000 screens, and Rajasthan has 2,112.

- Madhya Pradesh has 1,518 screens, and Assam has 837.

- Punjab has 700 screens, and Uttarakhand has 350.

- Goa has 300 screens, and Chandigarh (UT) has 275.

- Himachal Pradesh has 105 screens, and Bihar has 100.

- Jammu and Kashmir and Ladakh (UT) have 200 screens.

Pricing Variations

The EY report also provides insights into how pricing varies for digital OOH ad slots based on screen size and location. The average price per month per ad slot (with an average of 200 ad plays per day for six advertisers per day) is:

- Small screens (under 36 inches): INR 3,500 – 9,000.

- Medium screens (36-60 inches): INR 15,000 – 30,000.

- Large screens (60-100 inches): INR 100,000 – 600,000.

- Spectacular screens (over 100 inches): INR 1.5 million – 5.5 million.

Expert Opinions

The EY report includes commentary from industry experts on the trends and future of the OOH sector:

- Pawan Bansal, Jagran Engage: “Roadstar, a common, industry endorsed OOH measurement matrix, has been adopted by most leading OOH media agencies. This will lead to a data driven approach to OOH media planning and evaluation. This paradigm shift along with rapid proliferation of DOOH is likely to substantially increase spends in the medium .”

- Narayanswami Shekhar, Times OOH: India’s OOH industry is poised for transformative growth, driven by digital integration, data-led targeting, and smart infrastructure. With urban expansion and DOOH advancements, the sector will redefine audience engagement, delivering im pactful, measurable, and innovative advertising solutions

- Jahan Mehta, Selvel: OOH could soon become the most sought-after media by CFOs and procurement teams. With a robust audience metric showing the real number of people that go past each billboard, our biggest problem of lack of measurement could soon become our biggest strength.

- Shripad Ashtekar, Signpost India: “AI-powered, data-driven DOOH is projected to capture over 35% of OOH spending across 50+ cities and Transit media is set to witness its highest growth in three years. AI-driven planning will replace intuition and enhance transparency, making it more measurable.”

- Sunil Vasudeva, Pioneer Publicity: “Digital will continue to increase its share in total OOH revenue in 2025. Premium inventory remains in high demand, but the industry needs to expand by growing revenues outside the top 8 cities of India. That will drive more balanced growth.”

- Srikanth Ramachandran, Moving Walls: “There is a trend of global marketing decisions being made in central hubs as media planning, buying, and measurement get increasingly automated. This aligns perfectly with the growth of DOOH inventory in not just traditional settings but also across retail environments, linking campaigns to various outcome metrics.”

- Alok Jalan, Laqshya Media Group: “If we look at media consumption habits of today’s youth then OOH is finding itself in a unique position. We are seeing brands invest more share of wallet on OOH because of higher mobility of millennials and gen z as well as reducing ROI from other traditional mediums. DOOH is transforming the landscape and is able to attract many unconventional brands specially on transit and billboards.”

- Gulab Patil, Lemma Technologies: “The industry is forging the future of connected experiences. Strategic integration of OOH is becoming pivotal, acting as a crucial node in the audience journey. This interconnected ecosystem moves beyond mere impressions, fostering tangible business growth and brand loyalty.”

Conclusion

The Indian OOH advertising sector is dynamic and growing, driven by digital transformation and the expansion of transit media. While challenges remain, the industry is poised for continued growth and innovation, with increasing emphasis on data-driven approaches, creative campaigns, and immersive experiences.

-

Brand Insights

Brand InsightsFrom reminder to revenue driver: How L&T Finance is rethinking OOH

-

International Events

International EventsYasuharu Sasaki, Global Chief Creative Officer, Dentsu, named Grand Jury President of ADFEST 2026

-

Company News

Company NewsMoving Walls Group acquires OOH software provider Adarth

-

Industry News

Industry NewsOOH industry hits the pitch at OACL 2026 in Mumbai