Media Planning & Buying

Ad revenues to grow at +12.6% CAGR: Magna forecast

India is recovering from aftereffects of demonetisation introduced in Q4 2016 and the currency deficit faced during this period has helped the country leap frog towards a lesser cash economy. The country is set to move towards a uniform tax regime with Goods & Services Tax (GST), effective July 2017. While this fuels growth it is likely to create a fleeting disruption in the short term when the industry realigns and adapts to the new tax structure. GDP in real terms is estimated to grow +7.2% in 2017 compared to +6.8% in 2016, according to International Monetary Fund (IMF). Within the next decade India will gallop to become one of the largest consumer markets in the world. Rising affluence, ease of doing business, urbanisation and enabling infrastructure will contribute to this status.

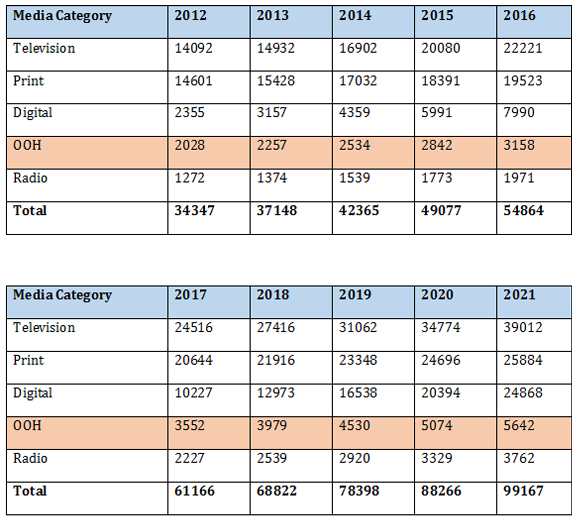

Advertising revenue which accounts for 0.38% of GDP is likely to grow at a CAGR of +12.6% to touch Rs 992bn by 2021. Within advertising, offline is estimated to grow at a CAGR of +9.7%, while digital will grow at +25.5% CAGR in the next 5 years. Mobile is projected to overtake desktop by 2020. Television will still be the largest media in 2021 with a market share of 39%.

Advertising revenue which accounts for 0.38% of GDP is likely to grow at a CAGR of +12.6% to touch Rs 992bn by 2021. Within advertising, offline is estimated to grow at a CAGR of +9.7%, while digital will grow at +25.5% CAGR in the next 5 years. Mobile is projected to overtake desktop by 2020. Television will still be the largest media in 2021 with a market share of 39%.

In 2017, Adex is estimated to grow +11.5% to touch Rs 611bn, predicts Magna, the intelligence, investment and innovation strategies agency of IPG Mediabrands. Ad spends will be driven by sectors like social, fin-tech, and payment banks, telecom service, content distribution platforms etc., in addition to FMCG, auto and Ecommerce.

OOH will grow at +12% in 2017. Technology integration will increase effectiveness and help DOOH to drive ad spends. Urbanisation in the form of new Metro lines and smart cities, modernisation of Indian Railways and their new advertising policy, etc., will provide opportunities for a planned development of quality assets and also push the industry to innovate and move beyond billboards. Regional cinema is pushing boundaries to outdo Bollywood cinema which augurs well for the industry.

Table: Media owner revenue by category in INR Cr Net