Contracts & Investments

OOH Industry leaders share their views on the Omnicom-IPG merger

Abhijit Sengupta, CEO, OAP Mediatech; Pramod Bhandula, Executive Chairman, JCDecaux; Rohit Chopra, COO, Times OOH share their insights on this merger and how it will affect the industry

Omnicom Group and Interpublic Group (IPG) have announced a groundbreaking merger that is set to redefine the global marketing and sales landscape. The union of these two advertising giants will create a powerhouse in media buying, creative services, and integrated marketing solutions. This merger consolidates a significant portion of the market under one dominant entity, reshaping competition and opening avenues for innovation in ad tech and artificial intelligence.

Under the terms of the agreement, Interpublic shareholders will receive 0.344 Omnicom shares for each share of Interpublic common stock they own. Following the close of the transaction, Omnicom shareholders will own 60.6% of the combined company and Interpublic shareholders will own 39.4%, on a fully diluted basis. The transaction is expected to generate annual cost synergies of $750 million.

We sought inputs from industry leaders in the media and OOH sector, and they shared their views on the implications of this significant merger.

Abhijit Sengupta, CEO of OAP Mediatech, commented, “It’s quite a big one to be honest. Can’t wait to see how the various brands emerge in the shorter and longer term. In India, I could see quite a bit of synergies without much overlap. Like Rapport is part of IPG, whilst Omnicom outsources OOH services worldwide as well as in India.”

Pramod Bhandula, Executive Chairman of JCDecaux India, noted, “It’s a grand merger, focus on ad tech and AI clearly are on cards for Omnicom. Good for Indian brands to have options. IPG with its huge existing India portfolio stands apart and this merger will surely create further expansion bringing healthy competition.”

Rohit Chopra, COO of Times OOH, elaborated, “The merger creates a powerhouse in global media buying and creative services, reshaping competition by consolidating market share under one dominant entity. Smaller agencies may struggle to compete and might pivot towards niche or specialized offerings to remain relevant. While clients gain access to a wider range of integrated solutions, their bargaining power could diminish.”

This merger signifies a pivotal moment in the advertising industry, with implications for global and regional markets. The combined strengths of Omnicom and IPG promise enhanced capabilities for clients while posing challenges for competitors to adapt to this new market reality.

-

Creative Concepts

Creative ConceptsChupa Chups and Zepto collaborate to bring “Childlike Fun” this Holi

-

Campaigns

CampaignsSwiggy Instamart dominates Gurgaon with “Giant Water Gun” OOH activation

-

Campaigns

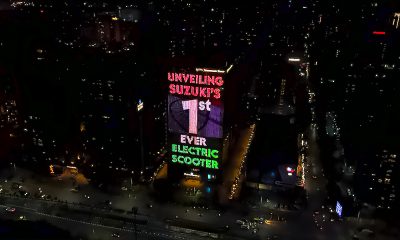

CampaignsA marriage of wearables announced in style

-

Creative Concepts

Creative ConceptsGrab uses clever shadow-play billboard to reveal the impact of rider earnings