Industry News

World Out of Home Organisation releases 2025 Global Expenditure survey

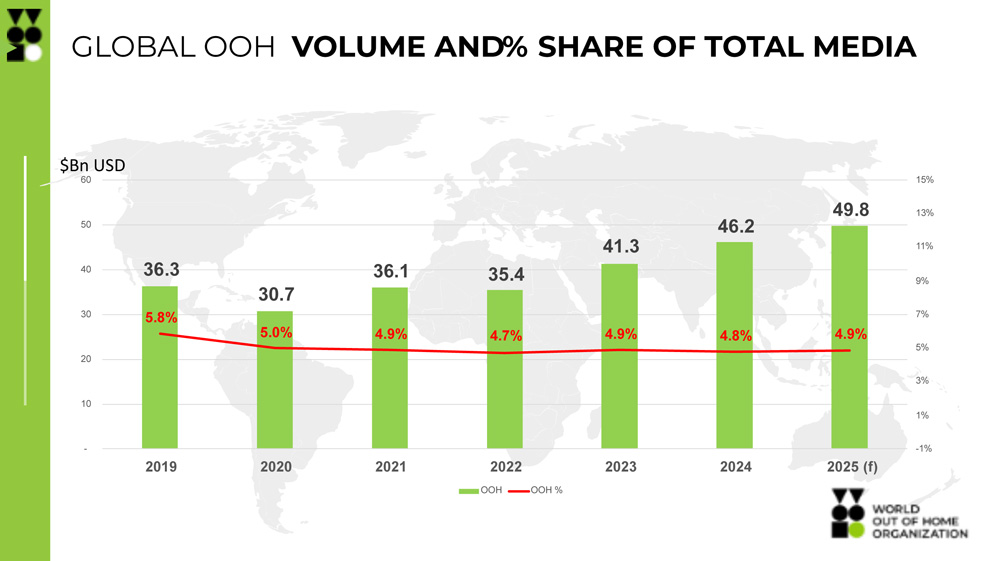

The 2025 WOO Expenditure survey captures expenditure globally for OOH across 2024 and give estimates of OOH expenditure for 2025. It is conducted by the use of a short form questionnaire to WOO members and OOH associations across the world and represents the most comprehensive survey of OOH expenditure globally.

Building on data for each year back to 2019, the WOO Global Expenditure survey allows the tracking of the growth and investment into Out of Home (OOH) media alongside local economic conditions and the development of Digital Out of Home (DOOH) as it drives growth for OOH globally. Understanding these growth drivers at a market and regional level allows WOO members and OOH Trade Associations to look to other markets for learnings to promote growth in their own markets.

The 2025 survey was completed by 95 members, covering 85 unique territories – collectively representing 95% of global GDP and 79% of global population. Unreported territories are modelled from similar territories based on population, total GDP and GDP per capita where possible, or are excluded from the study.

Global OOH spend in 2024 reached $46.2bn USD and represented 4.8% of global ADEX – breaking through the $45bn barrier and up $1bn on the predicted spend for 2024 – OOH media globally has had its best year to date, and OOH spend is forecast to grow to $49.8bn USD in 2025.

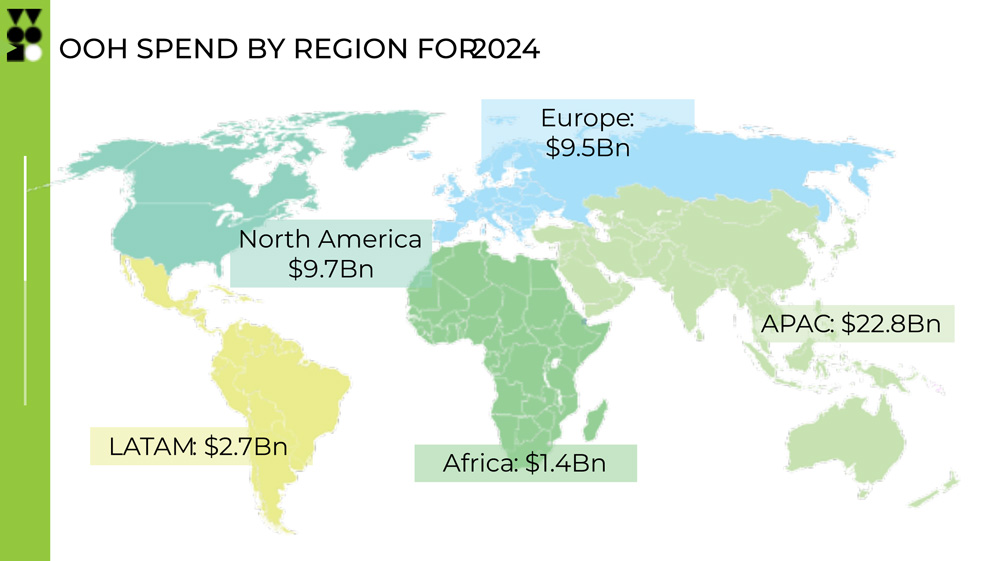

Regionally APAC dominates with 49% of global OOH spend at $22.8bn against 40% of global GDP. North America reports $9.7bn, 22% of the total, which alongside Europe ($9.5bn), LATAM ($2.7bn) and Africa ($1.4bn) track behind their share of GDP – although expenditure reporting in Africa is more challenging in Central Africa and is likely to be under-reporting much of the informal economy.

Global DOOH expenditure rose to $17.9bn USD in 2024 representing almost 39% of all OOH revenues and remains the main driver of OOH revenue growth globally.

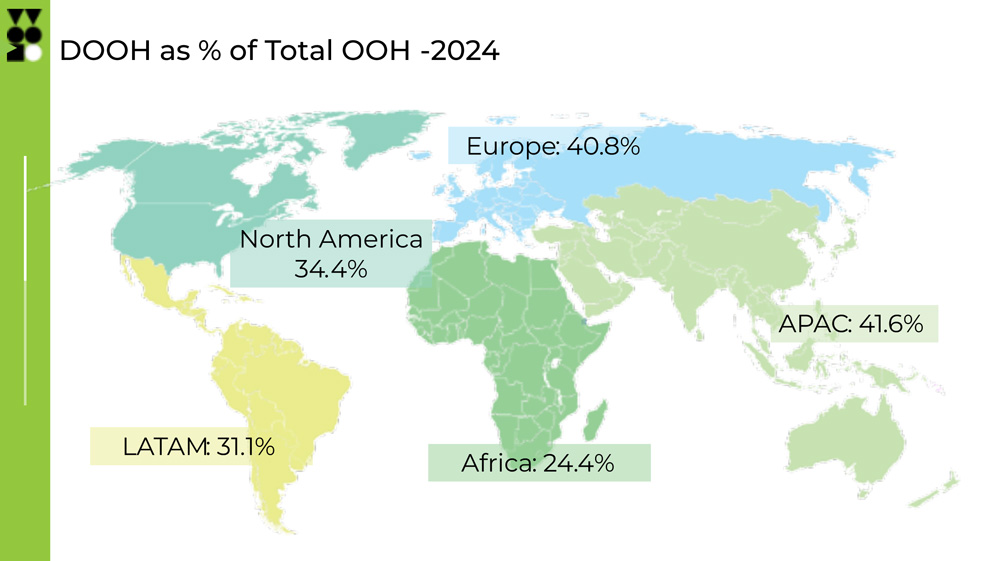

Investment in DOOH infrastructure varies across the world with APAC and Europe ahead of the global average at 41.6% and 40.8% respectfully. North America at 34.4% , LATAM at 31.1% and Africa at 24.4% of total OOH revenues.

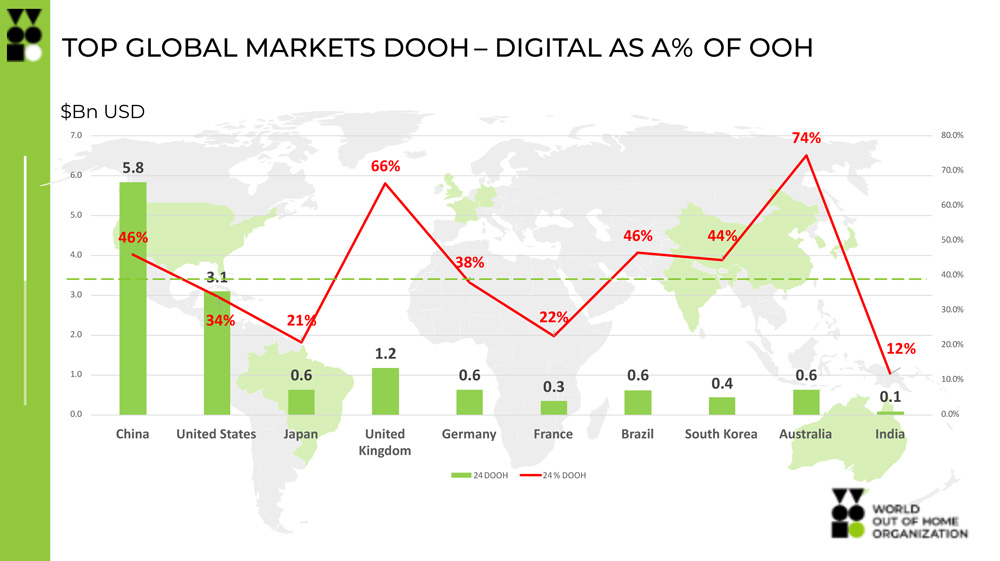

The ‘headroom’ for growth in DOOH is exemplified by territories that have invested heavily in DOOH screens – of the top 10 markets by overall OOH volume: Australia (74% of OOH revenue), UK (66%), China (46%), Brazil (46%) and South Korea (44%); lead the way in driving growth through DOOH.

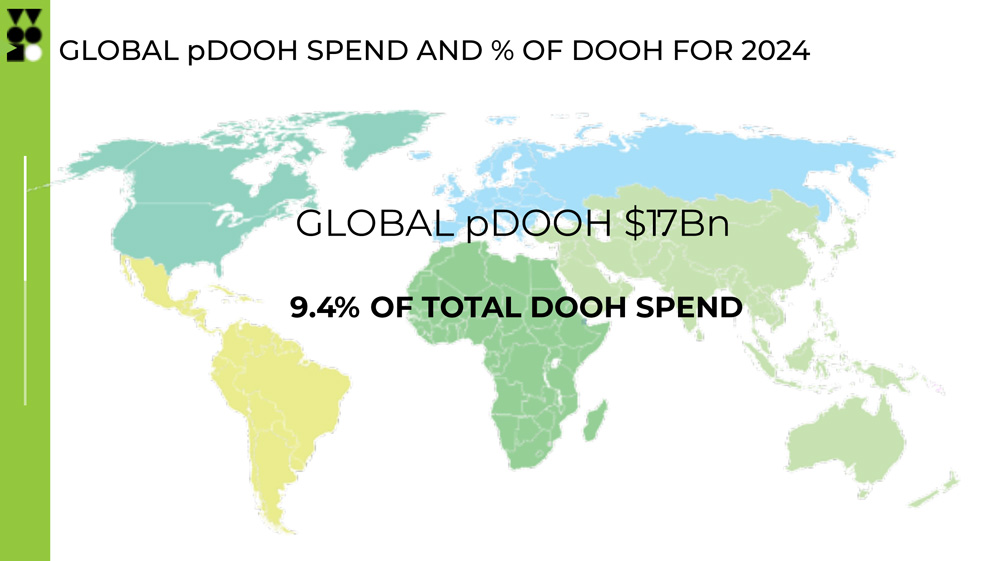

Programmatically traded DOOH grew to a reported total spend of $1.7bn USD globally, representing 9.4% of total DOOH revenues. Although this data is not captured commonly across all markets so may be under representative of the total revenue traded this way. We forecast continued growth to this figure in 2025 reaching 10.9% of all DOOH revenues, totalling $2.2bn USD.

-

Campaigns

CampaignsIGP launches two-way interactive billboard for Valentine’s Day gifting

-

Campaigns

CampaignsKotak Mahindra Bank launches OOH campaign for its Kotak811’s Infinity Metal Debit Card

-

DDX Asia

DDX AsiaThird edition of DDX Asia kicks off in Mumbai

-

Creative Concepts

Creative ConceptsVadilal’s 17-Foot melting Ice Cream turns Sabarmati Riverfront into a Valentine’s hotspot