Insights

Prestige meets proof in landmark OOH

In this column, Magesh Poondi, CEO, ReLu AI Systems, shares why even iconic sites like Sea Link or Times Square gain sharper impact when backed by audience data.

In the out‑of‑home (OOH) advertising landscape, landmark media sites—those iconic billboards at ultra‑prime intersections, major transport hubs, or city centers—have always been prized. Their status is born out of: visibility, heritage, cultural significance, and sheer presence which often affirm their value. But in today’s data‑rich environment, even these marquee assets benefit significantly from audience measurement.

Landmark sites: Built‑in Premium, Reinforced by Data

Landmark sites — like Mumbai’s Bandra-Worli Sea Link entrance or London’s Piccadilly Circus — are media real estate paragons. They command attention by virtue of their location, historical resonance, and the density of visibility. Advertisers have long trusted these locations with their flagship campaigns.

Yet even for marquee sites, audience data functions as reassurance. It validates assumptions about footfall, confirms demographic reach, and supports value-based pricing. Without measurement, selling airtime at premium costs hinges on reputation, not evidence. Audience data bolsters this, showing that landmark placements aren’t just “believed” to perform—they deliver measurable reach and frequency. It’s the difference between heritage appeal and evidence-based investment.

Data for Known vs. Unknown Markets

Where data shines brightest is in helping planners decide where to invest—especially when comparing sites or entering unfamiliar territory.

In well-known markets, like Mumbai or Delhi, planners often choose between high‑value but invisible sites — Pedder Road vs. Haji Ali. Data provides clarity on which yields higher daily impressions or superior audience profiles.

In new or less familiar cities, landmark sites may lack recognition. Here, data becomes a discovery tool. For instance, tollbooth‑style digital panels near Navi Mumbai’s Panvel station didn’t have built‑in prestige—but mobile-location audience data revealed foot volumes rivaling prime Mumbai sites. The data turned a speculative buy into a calculated move.

In both cases, measurement creates common consensus—between agencies, brands, and media owners—over which locations truly offer ROI, rather than rely on hearsay or legacy perception.

Global Examples: How Data Amplifies Iconic OOH

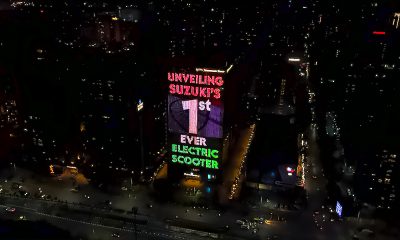

Example 1. Times Square, New York

Piccadilly-like in its urban magnetism, Times Square is legendary—even before any numbers. Still, OOH networks like Clear Channel develop impression dashboards showing daily unique reach, repeat exposure, tourist/resident split, and even “dwell-time” metrics based on mobile footprints. This data empowers media buyers to justify sky-high CPC-equivalents—lending empirical weight to the area’s global cache. Advertisers get the best of both worlds: iconic location and quantifiable impact.

Example 2. London’s ScreenX at Leicester Square

The Starcom and Ocean Outdoor digital site at Leicester Square markets itself as a cultural landmark. But when they overlay audience data, planners see finer insights—weekend family traffic, weekday tourist volume, even evening dwell-time during film premieres. These metrics help tailor creativity. For instance, geo-fencing pre-release film campaigns during evenings harvested higher frequency-on-target than generic branding—showcasing how data made the landmark sharper, more contextually relevant.

Indian Context: Heritage Meets Measurement

In India, marquee sites like Mumbai’s Metro Junction at Cuffe Parade or Delhi’s India Gate plaza serve both nostalgia and branding. Still, they are not immune to measurement‑driven optimization.

In Mumbai, iconic locations such as the Bandra-Worli Sea Link landing and Haji Ali junction—both traditionally viewed as high-impact zones. While these sites have always commanded premium interest due to visibility and symbolic value, RoadStar’s audience measurement reveals how impressions per viewer have actually increased over time, even with overall traffic redistribution from new infrastructure like the Coastal Road.

Similarly, digital DOOH at Lower Parel’s Phoenix Mills aggregates audience clusters via screen networks. While the site is already known for its premium catchment, measurement enables dynamic content release (luxury retail ads during weekend peak) and supports daypart pricing adjustments based on dwell-data.

Where Audience Data Really Makes a Difference

Creating a Baseline in Unknown Markets

Landmark status might not carry if a site is new—or if planners aren’t local. Data-driven reports help compare Reach and Frequency across cities and timeframes, making site value transparent.

Enhancing Strategic Negotiation

Media owners can show actual numbers—unique passers, impression averages, demographic splits—rather than rely on nominal territory. This fosters trust, closes deals faster, and supports premium pricing.

Refining Creative Impact

Landmark sites come with inherent contact—but analyzing dwell-time, repeat impressions, or segment-specific visibility helps shape campaign creatives and schedule logic for better resonance.

Not All Campaigns Need a Landmark

While landmark sites carry undeniable prestige, the choice of a media site ultimately depends on the campaign’s objective.

Is the goal to achieve high impact with a bold visual presence? Then a single, iconic location like Marine Drive in Mumbai or Times Square in New York makes sense.

Is the campaign focused on driving frequency through repeated exposure? Then a network of smaller, strategically located digital sites may outperform a singular landmark.

Or is wider reach across multiple demographic clusters the priority? In that case, planners may bypass high-cost icons in favor of broader city-wide visibility.

Audience data empowers these decisions. It helps identify where landmark sites best serve impact campaigns, and where alternate formats might better deliver scale or repetition. In this way, data ensures that every site—whether iconic or peripheral—is evaluated not just by perception, but by fitness to purpose.

The Balance: Heritage + Measurement

It’s important to emphasise that data doesn’t dethrone landmarks—it elevates them. Landmark sites are valuable even without metrics because of established presence and city-domain prominence. But when you layer audience analytics—based on mobile location, infrared dwell capture, ticketing or transit feeds—you move from belief-based value to proof-based performance.

This distinction is powerful:

- Media owners gain leverage in negotiations

- Planners gain confidence in OOH allocations

- Brands gain insight for optimizing both message and spend

Conclusion: Data Anchors the Iconic

Landmark OOH sites offer built-in prestige—but in today’s measurement-focused world, reinforcement from real-world audience data turns prestige into performance. Landmark sites remain important because of visibility and cultural presence—but data ensures they remain strategically relevant, not just symbolically iconic.

In India and abroad, planners rely increasingly on data to allocate budgets—regardless of heritage or hype. Where once “landmark” sufficed, now it must be backed by numbers. And in that synthesis—heritage amplified by clarity—lies the future of OOH effectiveness.

- (RoadStar: is a media planning and audience measurement platform built on GPS logs for Out of Home Media. RoadStar provides reach, impressions, frequency and profile of consumers across 900+ markets and 70,000+ media sites.

In India, IOAA approved platform, RoadStar, provides audience measurement for OOH Media. RoadStar reports 1600+ markets in India.)

-

Tenders

TendersPodhigai Media Group secures exclusive branding rights for Ahmedabad metro train

-

Campaigns

CampaignsMcDonald’s New Zealand lets menu names do the heavy lifting

-

Digital Display

Digital DisplaySurat unveils massive LED-illuminated display at Junomoneta Tower

-

Campaigns

CampaignsHeineken uses real-time weather data for ‘Temperature-Triggered’ DOOH campaign