Markets in Focus

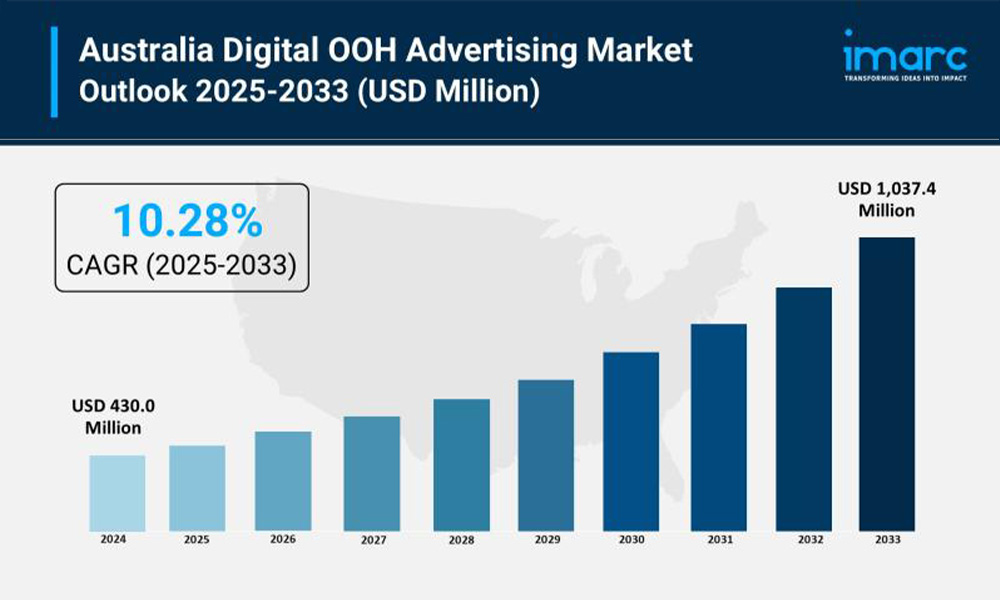

New IMARC study projects Australian DOOH market to cross US$1 Billion by 2033

The latest IMARC Group research reveals a rapidly expanding Digital OOH landscape in Australia, driven by infrastructure upgrades, smartphone adoption, and the shift toward data-driven advertising.

Australia’s digital out-of-home (DOOH) advertising market reached USD 430.0 million in 2024 and is forecast to grow to USD 1,037.4 million by 2033, representing a compound annual growth rate (CAGR) of 10.28 % during the period 2025-2033.

Key market drivers

According to IMARC, the growth is supported by several converging factors:

- Rising smartphone penetration, enabling deeper interaction between outdoor media and mobile devices.

- Advancements in display technology, allowing for digital screens with higher definition, dynamic content, programmatic buying and integration with mobile triggers.

- Growing demand for targeted advertising, as brands shift from static billboards toward more contextually relevant, real-time digital formats.

- Government investments in smart city projects and digital infrastructure, which expand the availability of premium digital outdoor media inventory.

- A shift from traditional (static) outdoor formats to digital media channels, driven by improved measurement, flexibility and audience connectivity.

Trends and format dynamics

IMARC highlights that the rollout of digital screens in high-traffic urban and transit environments is positively impacting the DOOH market. Examples include digital billboards in major cities like Sydney, Melbourne and Brisbane, as well as placements in shopping malls, airports, railway stations and bus stops.

With digital outdoor assets, advertisers gain access to large, mobile audiences, high-definition display environments and the ability to serve day-parted or context-aware messaging.

Segmentation by format, application and end-use industry

The report categorises the market as follows:

- By format type: Digital billboards; video advertising; ambient advertising; others.

- By application: Outdoor; indoor.

- By end-use industry: Retail; recreation; banking; transportation; education; others.

- By region: Australian Capital Territory & New South Wales; Victoria & Tasmania; Queensland; Western Australia; Northern Territory & Southern Australia.

Benefits and emerging opportunities

The research identifies several benefits to advertisers and media owners:

- The ability to engage audiences with dynamic, context-specific content and move beyond static billboard impressions.

- Enhanced targeting and interaction between digital outdoor screens and mobile devices, thanks to high smartphone ownership (over 90 %) and mobile connectivity in Australia.

- Improved cost-effectiveness and sustainability, as digital screens reduce reliance on paper-based media and simplify content updates without physical replacements.

Outlook and implications

With a clearly defined growth trajectory, Australia’s DOOH market offers a compelling case for investment and innovation. The forecast to US$1,037.4 million by 2033 signals that digital outdoor media is transforming from a complementary channel to a primary conduit for brand reach and engagement.

For advertisers, media owners and technology providers alike, the imperative is to deploy premium digital inventory, integrate mobile and data-driven insights, and evolve measurement capabilities to capture real-time audience behaviour.

As IMARC notes, the shift from static formats to digital platforms is reshaping the outdoor media landscape — and Australia is firmly on the path toward its next phase of OOH-driven growth.

-

People

PeopleCKA Birla Group appoints Himanshu Khanna as Group Chief Marketing Officer

-

Campaigns

CampaignsNetflix promotes ‘The Night Agent- Season 3’ with cheeky post-Valentine’s OOH billboard

-

Creative Concepts

Creative ConceptsNissan paints the sky over Udaipur to unveil its latest car

-

Insights

InsightsBuilding the case for a Data-by-Design approach in DOOH