‘The New Normal’ - A case of ‘Diffusion of Innovation’

By M4G Bureau - May 29, 2020

The ‘New Normal’ will emerge as segments of consumer economy resume daily living again, and take shape over a span of time says Feedback Insights report

Feedback Insights, a Bangalore based research firm, conducted a survey that brings to light consumer behaviour patterns that will reshape the economy in the post-COVID-19 world as the pan-India lockdown enforced by the government is being lifted progressively, with new rules to serve as precautionary measures to curb the spread of COVID-19. There are a number of things that people can- and cannot do when it comes to socializing, shopping, travel etc.

Feedback Insights, a Bangalore based research firm, conducted a survey that brings to light consumer behaviour patterns that will reshape the economy in the post-COVID-19 world as the pan-India lockdown enforced by the government is being lifted progressively, with new rules to serve as precautionary measures to curb the spread of COVID-19. There are a number of things that people can- and cannot do when it comes to socializing, shopping, travel etc.

Key Highlights

Key Highlights

More than half (55%) felt optimistic overall. The report also highlights that compared to when the lockdown began, overall 60% respondents feel much better now.

Understandably, the virus is the looming fear: about 50% are extremely- or very- worried about their family or themselves catching the virus. Worries about their job and/or business is next at 40%. The post-lockdown period is going to see major changes in the way consumers adapt and spend their time and money. The survey shows a blueprint of ‘the new normal’ by identifying the behaviour patterns which will begin ‘early’, ‘later than a year’ and ‘never’.

Early adoption:

- Meeting socially and alcohol purchases will start at once. (About two-thirds will engage within weeks)

- Online purchase too is expected to pick up rapidly. (60% will begin within 7-10 days)

- Many services will come back to normal fast. 50% respondents will begin using services within 10 days. Beauty Services are expected to restart within 30 - 90 days.

Late adoption:

- Eating at restaurants and shopping at malls, notably for apparel and shoes, would restart much later as it would take a few months to reach a 80% penetration level.

- Movies in theatres will need more than a year to see the audience coming back. Consumer durables and electronics see a slower pickup. While about 50% will restart purchasing within about 40 days, it will take about a year to see the 80% level of consumption return.

- The Stock Market would still rule, with 50% back to investing in weeks and 80% back in about 3-4 months. Medical insurance similarly sees a big upsurge with 50% planning to renew/repurchase medical insurance within weeks of the lockdown lifting.

- The survey suggests that self-employed/businessmen whose cash flows have eased (perhaps as a result of recent announcements) would lead this financial market behaviours.

Extremely late adoption:

- There are some categories that are poised to lose their consumers almost completely this year. This includes international travels, ‘Big Ticket’ purchases like house, vehicles, land etc. and Remodelling.

Interiors, furniture, etc. are likely to pick up only after one year of the lockdown being lifted

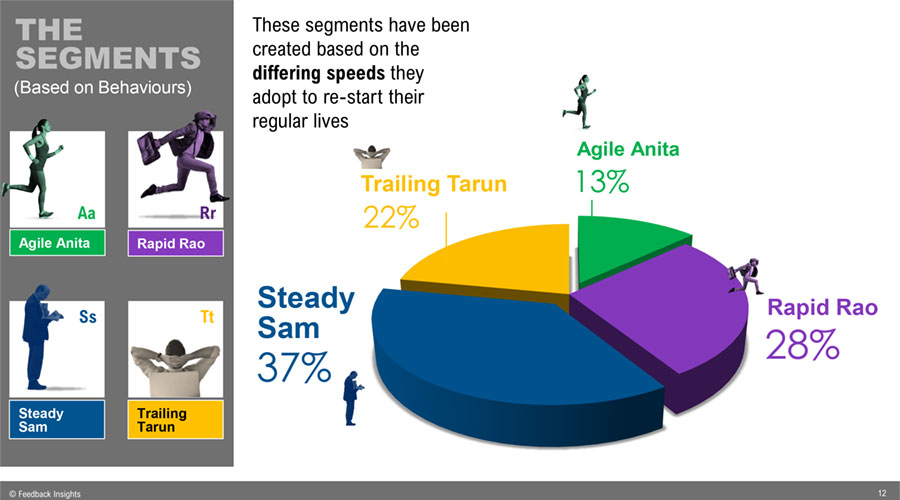

The report identifies four different consumer segments that differ in the speeds at which they are likely to adopt to the new norms and restart their lives.

- Agile Anita (13% respondents), the young, mostly south based, highly skilled finance or tech professional, non-gender biased

○ Less worried about job loss compared to others

- Rapid Rao (28% respondents), mostly entrepreneurs, risk takers, satisfied with erratic income

○ Most troubled by the need for savings

- Steady Sam (37% respondents)the older, affluent professionals with a steady income.

○ Most worried about the job loss, or salary cuts and the need for savings

- Trailing Tarun (22% respondents)the older who mainly stay at home. Some have completed their professional commitments, however this is mainly women dominated

○ More worried about the virus, than job loss / salary cuts or children’s schooling.

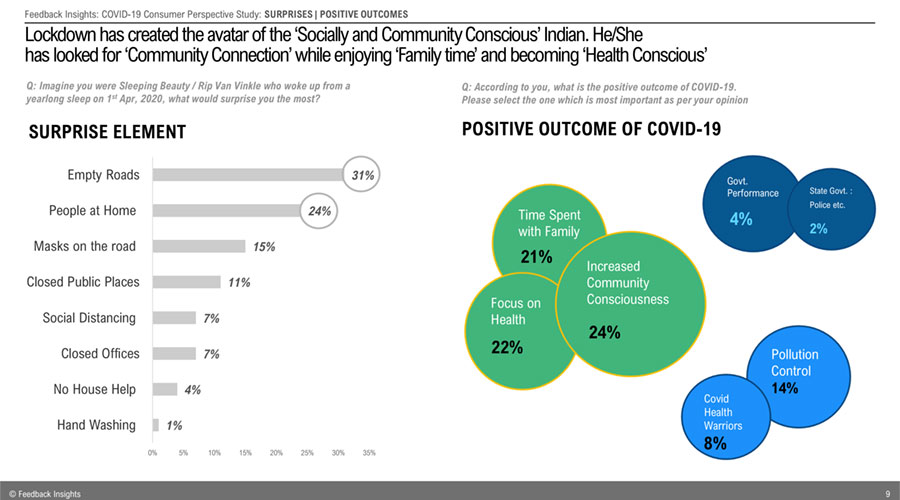

The three positive outcomes from the lockdown, according to the report, are, the time spent with family (81%), change in expenditure pattern (80%) and catching up on other activities (78%). The Rapid Raos and Steady Sams enjoy the time spent with family the most, among the 81% respondents. The respondents believe that the lockdown has had a negative impact on jobs/businesses (55%), physical health (28%), and sleep patterns (27%).

The three positive outcomes from the lockdown, according to the report, are, the time spent with family (81%), change in expenditure pattern (80%) and catching up on other activities (78%). The Rapid Raos and Steady Sams enjoy the time spent with family the most, among the 81% respondents. The respondents believe that the lockdown has had a negative impact on jobs/businesses (55%), physical health (28%), and sleep patterns (27%).

Since the lockdown, the majority of respondents have started focusing more on their health by eating healthier than before (55%), and exercising (36%). However, about 60% of the respondents are eating less non-veg food than before. 36% respondents are spending more time on work than before. This includes more of Steady Sams and Rapid Raos. The data also shows that the time spent on stock markets has also reduced, with about 49% respondents spending lesser time than they did before the lockdown.

Between April 24th - 29th, 2020, over 1214* respondents participated in the survey. The key premise is that consumers will embrace new behavioral norms, both personal and social. This shall manifest in new patterns of consumption as consumers work to rebuild post a catastrophic disruption in life.