OOH to grow at 9% in 2020: DAN Digital Report

By Bhawana Anand - January 24, 2020

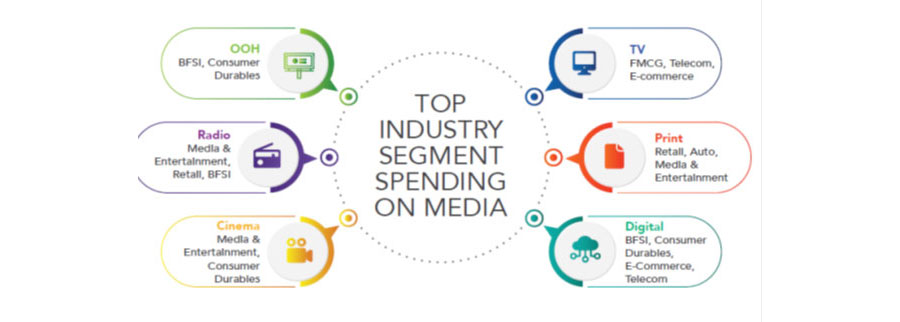

BFSI & Consumer durables are top spending categories on OOH media

Dentsu Aegis Network released DAN Digital Report 2020 yesterday in Delhi with a deep discussion on the advertising by the seasoned professionals. According to the report, the Indian advertising industry has grown at a rate of 9.4% over 2018 to reach Rs. 68,475 Crore by the end of 2019. The industry will grow by 10.9% to reach Rs. 75,952 Crore by the end of 2020. It is expected to grow at 11.83% CAGR to reach a market size of Rs. 1,33,921 Crore by 2025.

Dentsu Aegis Network released DAN Digital Report 2020 yesterday in Delhi with a deep discussion on the advertising by the seasoned professionals. According to the report, the Indian advertising industry has grown at a rate of 9.4% over 2018 to reach Rs. 68,475 Crore by the end of 2019. The industry will grow by 10.9% to reach Rs. 75,952 Crore by the end of 2020. It is expected to grow at 11.83% CAGR to reach a market size of Rs. 1,33,921 Crore by 2025.

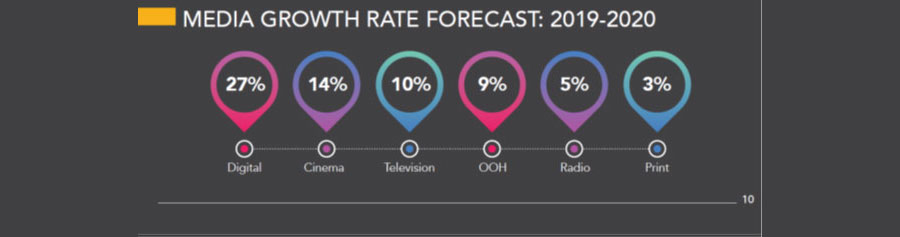

MEDIA AD SPENDS FORECAST

The report also predicts that in 2020, Out of Home is expected to grow consistently at 9% to retain the market spends share of 6%. Urban designers and planners believe that advertising will play a crucial role in formulating urban business models, with the advertising revenues funding development and impetus on smart city projects. In addition to that, the growing trend in the digital OOH space focuses on capturing relevant data and adopt programmatic to drive rate benchmarking and minimize the human intervention in buying. And the cinema is expected to sustain the current growth rate of 14% through next year.

Advertising spends on Digital media is expected to grow at a CAGR of 27.42% to cross the Rs. 50,000 Crore mark and reach an industry size of Rs. 58,550 Crore by the end of 2025. In the year 2020, spends on Television media is expected to grow at 10% and its share will remain steady while that on Print media is expected to grow at 3% with this share declining to 27%.

Anand Bhadkamkar, CEO, Dentsu Aegis Network India, “2019 was a challenging year for the Indian advertising industry as well. With the economic slowdown, advertisers decided to cut back on spends, consumers decided to wait-and-watch, market sentiments reached a new low and India’s Ad Expenditure (AdEx) witnessed a consequential fall. But even in the midst of it all, digital continued to grow. Digital is a masterstroke in advertising and Dentsu Aegis Network recognizes this strength. We also recognize the need for an industry level report that can give directions toward which this industry is moving. While with every new edition, the DAN Digital report has been upping its rank in quality, range and comprehensiveness, we welcome sincere feedback and inputs from the entire industry to help establish a robust eco-system for this fast growing and increasingly important industry channel, so that all of us can progress together!”

Ashish Bhasin, CEO, APAC and Chairman, India - Dentsu Aegis Network, said, “The Media and Advertising industry is shifting at a rapid speed and Digital is certainly taking charge. Consumers are leaving behind huge digital footprints and there is a lot more emphasis on managing data and developing martech capabilities, now. 2020 is expected to witness a major change in advertising in India, with digital becoming a bigger medium. In fact, by 2021, it’s growth should surpass that of print. Yet, despite this progressive swing, the industry has failed to come together to agree upon a common measurement metric for digital. As leaders in digital, Dentsu Aegis Network today stands at the forefront of this evolution and understands the need to have more information on Digital. The DAN Digital report, now in its fourth edition, is exhaustive, systematic, thorough and meets this need gap brilliantly. The report has now become the most credible source of information when it comes to digital in India.”

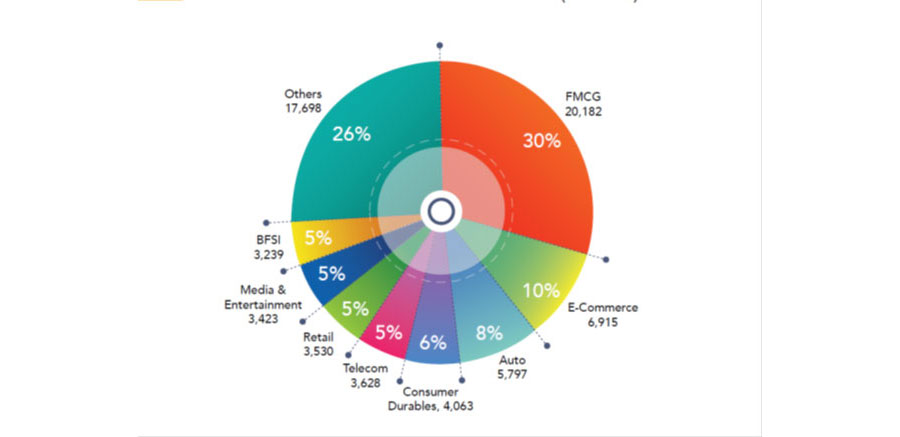

AD SPENDS BY INDUSTRY VERTICALS (INR CR)

Across various industry verticals, FMCG sector spends the highest by contributing 30% (Rs. 20,182 Crore) to the advertising industry. Next to FMCG stands with 10% contribution by E-commerce (Rs. 6,915 Crore) followed by Automotive sector (8%, Rs. 5,797 Crore).

Stay on top of OOH media trends