OOH to grow 10% in 2018: Pitch Madison Report

By M4G Bureau - February 16, 2018

Retail, Consumer Services and Real Estate have been the top three consuming categories of OOH. However, Consumer Services (Hospital, Restaurant and Education) reduced spends by 8% and Real Estate spends too declined by 11%. The highest growth was recorded by the Telecom category at 29%

The annual Pitch Madison Report 2018 released at a conference held in Mumbai yesterday cites that OOH advertising market has grown by 6% in 2017 to reach a size of Rs 3,085 crore. Its contribution to the advertising pie was 5.8%. The conventional OOH market grew at 7% and Transit Media at 4%.

The annual Pitch Madison Report 2018 released at a conference held in Mumbai yesterday cites that OOH advertising market has grown by 6% in 2017 to reach a size of Rs 3,085 crore. Its contribution to the advertising pie was 5.8%. The conventional OOH market grew at 7% and Transit Media at 4%.

Retail, Consumer Services and Real Estate have been the top three consuming categories of OOH. However, Consumer Services (Hospital, Restaurant and Education) reduced spends by 8% and Real Estate spends too declined by 11%. The highest growth was recorded by the Telecom category at 29%, attributable to the launch of Reliance Jio with its aggressive pricing strategy. Mumbai continued to be the largest contributor to OOH at 18%, followed by Delhi at 14% and Bengaluru at 11%.

“We expect the Outdoor advertising sector to grow by 10% in 2018, taking its Adex to Rs 3,395 crore. Outdoor is expected to substantially gain from the Central and State Government’s publicity and election campaigns, because of the ensuing eight State Assembly Elections in 2018 and Lok Sabha Elections in 2019,” the report states.

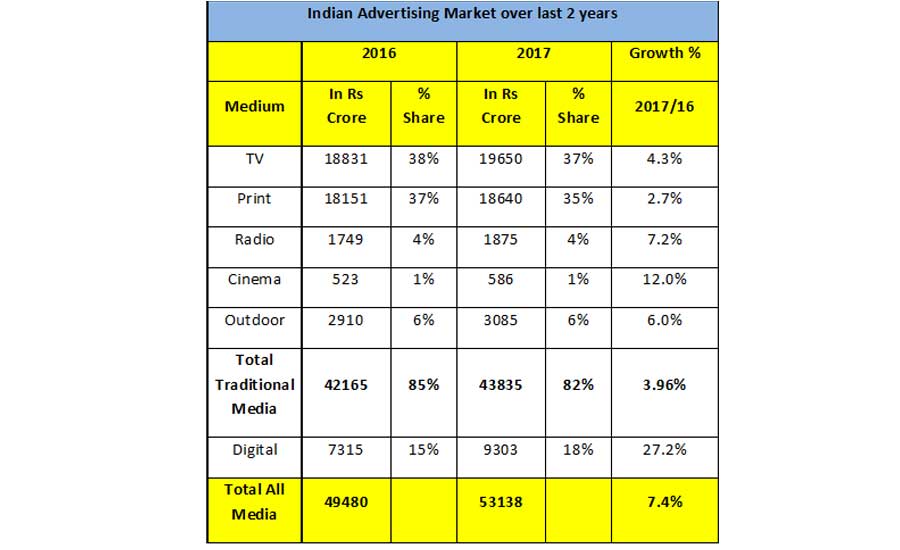

The report forecasts that overall Adex in India will grow by 12.03% taking the industry to Rs 59,530 crore. Highest growth rate will likely be achieved by Digital (25%) followed by Cinema (14%), TV (13%), Radio & Outdoor (10% each) and Print (5%). The report clearly states that as a result of demonetisation and GST implementation, the Adex went up by only 7.4% in 2017.

Commenting on the overall report, Sam Balsara, Chairman, Madison World said, “Demonetisation and GST have caused headwinds resulting in a stunted Adex. We are cautiously optimistic about 2018 and project a growth rate of 12% for 2018 with Digital again growing by 25%. To take advantage of the figures released by IRS which revealed dramatic growth in Total Readership, publishers will be well advised to offer incentives to advertisers for repeating the same ad in the same publication 2-3 times a month.”

Figures at a glance:

Key findings:

• Growth in the Indian Advertising Market slowed down to 7.4% in 2017, owing to the after-effects of demonetisation and GST roll out. Traditional Media during 2017 grew by only 4%, the lowest in half a decade while Digital Media grew by 27.2%, taking the overall growth to 7.4%. In absolute terms, the Indian Ad market grew by Rs. 3,658 crore to take the industry to Rs. 53,138 crore in 2017.

• Adex was slow to recover from the impact of demonetisation and first quarter of 2017 saw a de-growth of 2% and a growth of mere 2% in second quarter. Just when it was expected that Adex will gather steam, GST was announced in July and the market saw a drop of close to 20% in traditional media over June 2017 and a drop of 5% as compared to July 2016. The festive period brought cheer to Adex and it grew from August to December by 13%. But because of the slow start in the first half and a drop in July the whole year’s Adex is estimated at Rs. 53,138 crore, a growth of mere 7.4%.

• With a growth rate of 7.4%, the Indian Market has lost its stellar position of being the fastest growing advertising market in the world and has conceded that position to Russia, going by WARC estimates of international markets.

• Television continues to be the largest contributor to Adex with 37% share, but grew by just 4.3%, closely followed by Print at 35% share but with even a lower growth of just 2.7%.

• Digital that grew by 27.2% now contributes to a whopping 18% of Indian Adex. Digital gained 3% share points at the expense of Television and Print who lost 1% and 2% share points respectively.

• Radio, Cinema and Outdoor have all grown at a much faster pace than Television and Print and maintained their share in 2017. But share of Digital continues to be more than combined share of Radio + OOH + Cinema and we don’t expect this trend to change in near future.

• The categories that have contributed to growth in Print, Television and Radio (and accounted for 56% of growth of Rs. 3,658 crores) have been FMCG followed by Telecom and Automobiles. FMCG continues to be the most dominant sector with a 32% share followed by Auto at 10% and Telecom at 8%. E-commerce that had taken the media market by storm three years ago contributed only 4% to Adex (compared to 10% in 2015). With implementation of Real Estate Regulation and Development Act (RERA), Real Estate and Home Improvement category as a whole has registered a de-growth of -3%.