OOH to be back in growth mode, says dentsu global report

By Bhawana Anand - February 10, 2021

With the recovery of auto and passenger traffic, OOH ad spend is expected to recover at 14.9% growth in 2021, according to the report

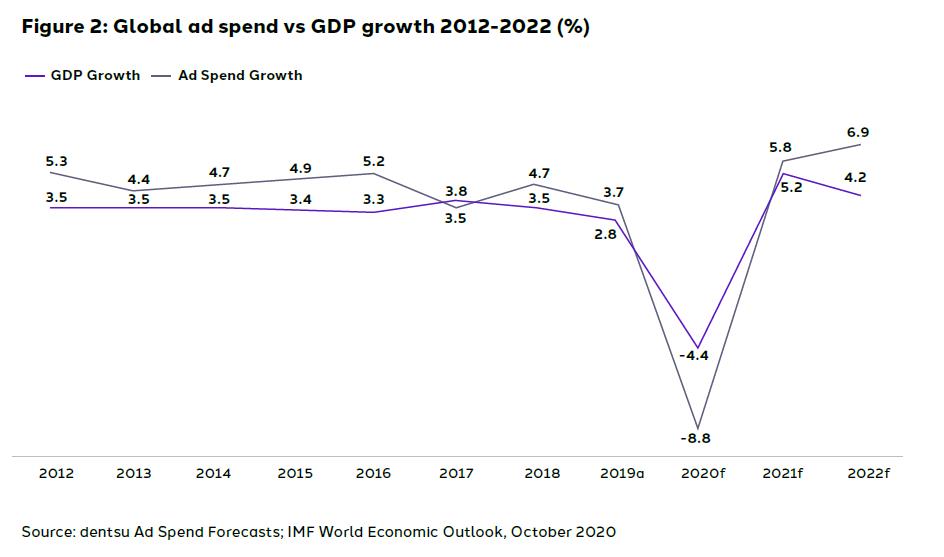

dentsu recently released its 2021 forecast for Global Advertising Spend (Ad Spend) report based on data derived from 59 markets and predicts global ad spend growth of 5.8% in 2021, amounting to USD579 billion. Ad spend in Asia Pacific, home to 60% of the world’s population, is expected to grow by 5.9%, with share of digital forecast to increase 9.1% to a share of 57.5% of all spends.

Overall, 2021 global ad spend is forecast to remain below the pre-pandemic level of US$600 billion recorded in 2019. However, expectations are that global ad spend will recover and exceed this level in 2022, when spending of US$619 billion and a growth rate of 6.9% are forecast. Clearly, all forecasts are dependent on the evolution of the global pandemic, government restrictions and the development and implementation of a vaccine.

Overall, 2021 global ad spend is forecast to remain below the pre-pandemic level of US$600 billion recorded in 2019. However, expectations are that global ad spend will recover and exceed this level in 2022, when spending of US$619 billion and a growth rate of 6.9% are forecast. Clearly, all forecasts are dependent on the evolution of the global pandemic, government restrictions and the development and implementation of a vaccine.

“If 2010s saw the rise of FOMO (Fear of Missing Out), the turn of the decade changed the feeling to FOGO (Fear of Going Out). Conspicuous consumption has been replaced by anxiety and sheltering, with many cautious about doing things that used to be ‘normal’, including shopping, using public transport, and being in crowded spaces. By the summer of 2020, one third of the world’s population had been in some form of lockdown, huddling close to the safety of our homes, as our lives shifted online, resulting in considerable increase in the use of at-home media such as Netflix, Zoom, and Twitch,” said Ashish Bhasin, CEO, dentsu APAC.

Market outlook

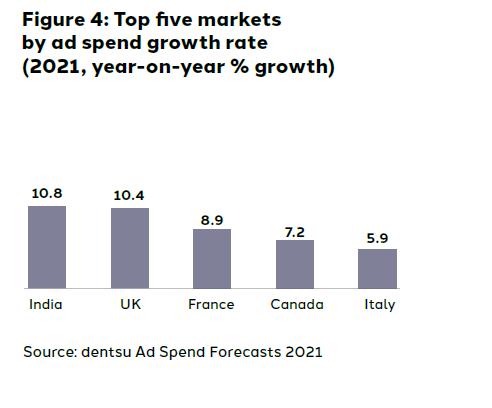

A return to growth is predicted for all regions in 2021 driven by Western Europe (7.5%), Asia-Pacific (5.9%) and North America (4.0%). As with the global outlook, this represents a significant recovery, but with ad spend remaining below pre-pandemic levels. By market, the top five contributors to the forecast US$32 billion of incremental ad spend growth in 2021 will be the United States, China, Japan, the United Kingdom and France.

Highlighting the status of Indian Ad spends market, the report states, the ad market in India is expected to grow by 10.8% in 2021, following a sharp decline of 17.5% in 2020. With the economy recovering (the IMF forecasts real GDP growth of 8.8% in India in 2021) and the gradual easing of lockdown measures, both consumer and advertiser sentiment are expected to bounce back strongly. The second half of 2020 has seen a number of large advertisers post impressive sales growth numbers, taking momentum into 2021.

Highlighting the status of Indian Ad spends market, the report states, the ad market in India is expected to grow by 10.8% in 2021, following a sharp decline of 17.5% in 2020. With the economy recovering (the IMF forecasts real GDP growth of 8.8% in India in 2021) and the gradual easing of lockdown measures, both consumer and advertiser sentiment are expected to bounce back strongly. The second half of 2020 has seen a number of large advertisers post impressive sales growth numbers, taking momentum into 2021.

Media outlook

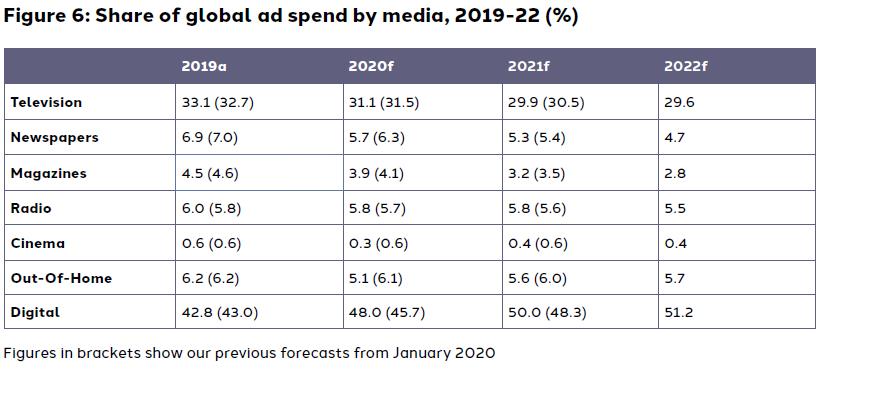

While a gradual return to normality is expected as lockdowns ease in 2021, the impact on media consumption behaviours is likely to endure. However, understanding permanent vs temporary changes in consumer behaviour will be the number one challenge facing many brands.

Out-of-home back in growth

Out-of-home back in growth

With restrictions on social activity, outdoor advertising and related out-of-home media (such as cinema) was disproportionately impacted by the crisis. With the recovery of auto and passenger traffic, OOH ad spend is expected to recover at 14.9% growth in 2021. Digital OOH is evolving quickly, both its offer (including programmatic capabilities) as well as demand (advertisers’ use of this media).

Box office performance

Cinema ad spend is forecast to recover by 41.7% in 2021 (following a drop of 58.3% in 2020), reflecting the expected return to movie houses around the world. New innovations will help attract new audiences too. For example, in June 2020, Fortnite announced a Christopher Nolan-themed movie night on their platform, representing the potential in a post-lockdown world to attract a new generation of consumers seeking a more immersive cinematic experience.

Stay on top of OOH media trends