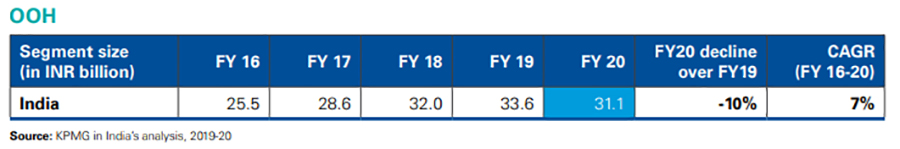

KPMG M&E 2020 reports OOH industry’s degrowth by -10% in FY20

By M4G Bureau - October 01, 2020

FY20 witnessed a decline in OOH revenues primarily due to a slowdown of the Indian economy in H2FY20 and the impact of lockdown imposed in March

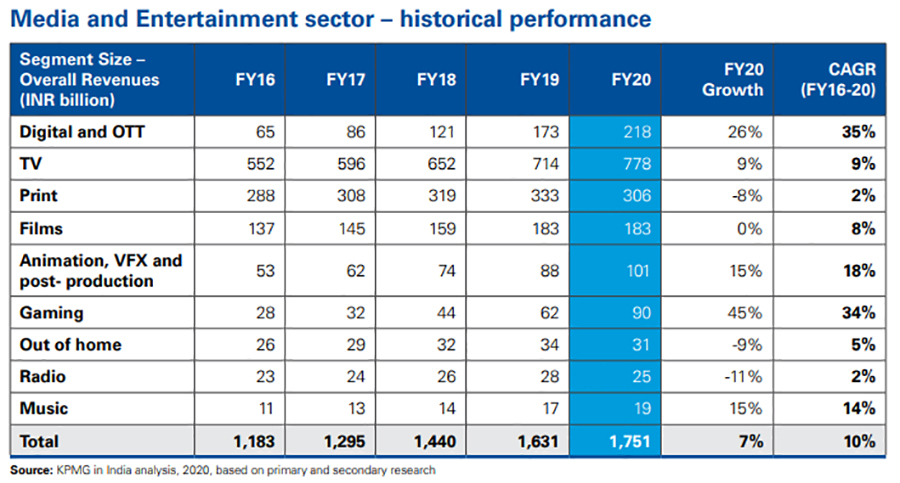

KPMG has launched its 12th edition of Media & Entertainment (M&E) 2020 report titled- ‘A year off-script: Time for resilience’ which is believed to have examined the performance of the sector during a particularly challenging period.

According to the report, India was already experiencing a slowdown in economic activity even prior to the outbreak of Covid19 in March, and the onset of the global pandemic and ensuing lockdown dealt a severe blow to the Indian economy.

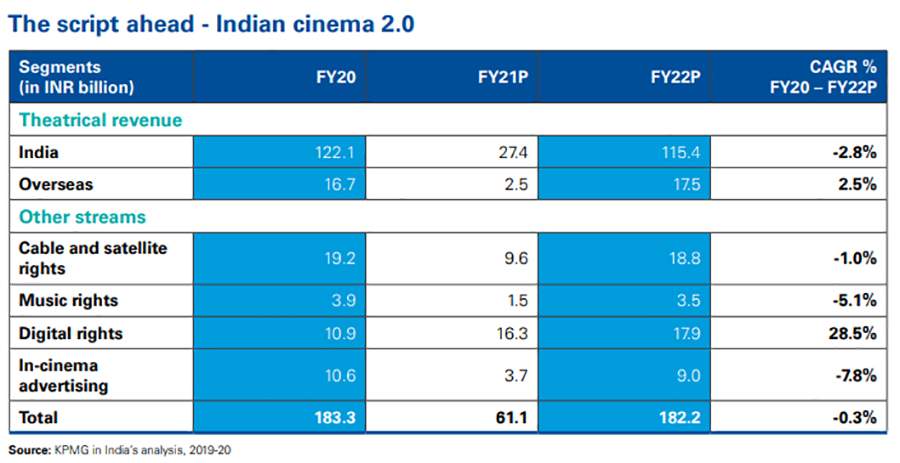

The M&E sector, which was badly hit due to the disruptions caused by the pandemic, is expected to recover to its current levels and post a 33% growth in FY22 (following a contraction of 20% in FY21), which still implies a loss of around two years of growth.

The two areas that offer encouragement are the continued economic growth of India and the universal acceleration of digital adoption among users across geographies.

Girish Menon, Partner and Head, Media and Entertainment, adds, “There will be a deeper integration of digital technology across the M&E value chain- from content production to distribution. Technology adoption could however face some challenges in terms of skill development and the shift to a digital-first mindset but will result in operational cost savings and potentially lower lead times over the longer term.”

The M&E sector has been affected but to varying degrees like outdoor entertainment formats (films and events) and traditional media (print and TV to some extent) have been badly impacted as people stayed indoors and advertising spends dried up, the report said.

It said that digital advertising, OTT and gaming fared much better, with massive spikes in digital consumption during the lockdown across geographies and socio-economic classes. Digital advertising spends are now set to overtake those on TV by FY21, which is an important milestone and turning point in the evolution of M&E in India.

“The distinction among segments of M&E has become more pronounced with the experience of the lockdown. Marketing spend has moved perceptibly towards digital media and away from traditional segments like print, radio and to some extent TV. A greater reliance on subscription and other paid options as well as the development of a credible digital business model is going to be inevitable for these traditional media segments”, says Satya Easwaran, Partner and Head, Technology, Media and Telecom, KPMG India.

OOH segment in FY20 witnessed a decline due to realignment of spends by advertisers during elections and cricket world cup, away from OOH and compounded by a slowing economy.

The report states that the OOH industry is expected to decelerate in FY21 with events getting cancelled and corporates pulling back advertising spends amidst the lockdown. As a result, the events industry is estimated to have suffered INR 30 billion losses in the first two months of lockdown which is expected to continue due to restrictions on movement imposed post-lockdown.

Most of the consumers have shown preference to remain indoors for their safety and avoid non-essential travelling. This coupled with closure of recreational facilities such as shopping malls, multiplexes and public parks.

Also, the report mentions that many hoardings sites around the country have found no takers and are blank leading to revenue losses. Few are being used to raise awareness regarding the pandemic. Product promotions, brand promotions, conferences, exhibitions, government programs and entertainment events have been either cancelled or postponed.

Stay on top of OOH media trends