‘India will be a Rs 1tn ad market by 2022; OOH Adex to grow 9.7% in 2018’

By M4G Bureau - December 11, 2017

IPG Mediabrands MAGNA Adex Prediction 2018 report forecasts that 2017 estimated Adex growth rate of +11.5% earlier in June has been revised marginally downwards to +11.1%. In 2018; the ad spends are expected to grow +12.1%

The IPG Mediabrands MAGNA Adex Prediction 2018 report, released this month, states that India has waned through the lingering impact of currency exchange in November 2016 and pass through effect of unified tax structure in July this year. Transitory costs for introducing bold structural reforms have been paid and upswing in economic activity is strengthening. The bank recapitalisation plan coupled with insolvency and bankruptcy code 2016 revives the sector and this will boost private investment. Revival in rural economy and growing middle class will boost economic growth.

The IPG Mediabrands MAGNA Adex Prediction 2018 report, released this month, states that India has waned through the lingering impact of currency exchange in November 2016 and pass through effect of unified tax structure in July this year. Transitory costs for introducing bold structural reforms have been paid and upswing in economic activity is strengthening. The bank recapitalisation plan coupled with insolvency and bankruptcy code 2016 revives the sector and this will boost private investment. Revival in rural economy and growing middle class will boost economic growth.

GDP in real terms is expected to grow +6.7% a speck slower than earlier projected +7.17%. In 2018 IMF report predicts growth of +7.4%.

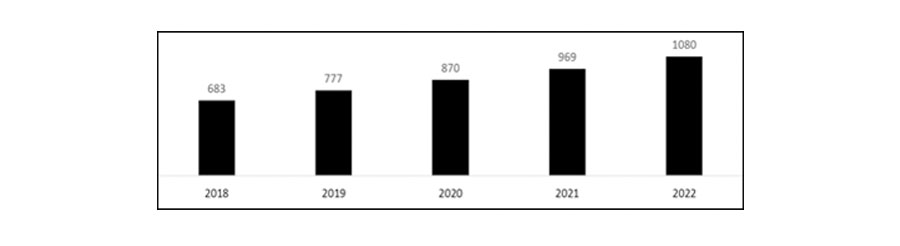

Advertising revenue will grow at CAGR of +12.1% in the next five years to touch INR 1.07 tn. Growth will be led by digital with +21.6%. Television will still rule the top as the largest media in 2022 with a market share of 41%. Digital and print will have equal share of 25%. Mobile will displace desktop as the 3rd largest category by 2020.

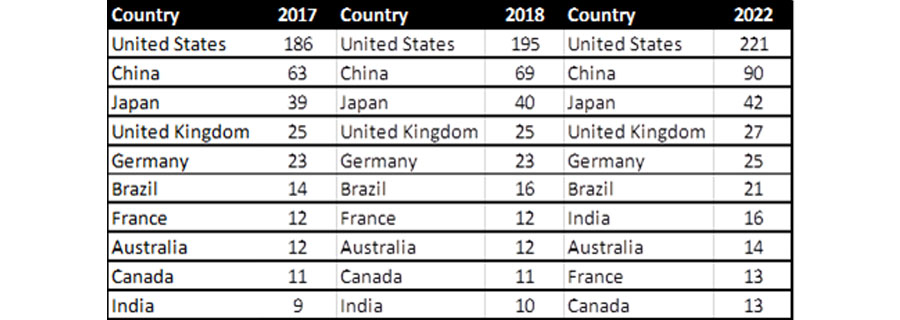

United States and China contribute close to 50% of the incremental ad dollars between 2018 and 2022 while India ranks third with a 6% contribution. The traditional categories like print are so strong and growing YOY in India that over 60% of this incremental dollars is coming from traditional categories.

2017 estimated Adex growth rate of +11.5% earlier in June has been revised marginally downwards to +11.1%. In 2018; the ad spends are expected to grow +12.1%. Categories driving up spends next year will be:

- Auto enjoys a strong domestic demand due to rising income, rising middleclass and a young population. Demand for commercial vehicles due to heightened infrastructure activity and government’s focus on electric vehicles to meet emission targets are some of the growth drivers.

- FMCG penetration will increase with modern trade growing faster in Tier-II and Tier-III cities. Raising disposable income among rural consumers, E-commerce strengthening their offering with daily products, evolving consumer lifestyle and government FDI policy is infusing growth.

- Banking demand will raise thanks to increase in working population. Housing and personal finance are key drivers. Government’s financial inclusion plan is expanding the reach of banking services and insurance coverage to rural segment.

- Consumer Durables demand will grow with rural electrification and e-commerce expansion.

- E-Commerce growth is propelled by increasing smartphone penetration, digital literacy combined with affordable data costs. GST will help E-commerce players to streamline supply chain and eliminate dual taxes. The sector is attracting more users from Tier-II and Tier-III cities.

Table 1 – Net Advertising Revenues by category (INR Cr Net)

|

Media Category

|

2017

(Jun Estimate)

|

2017 (Dec Estimate)

|

2017

% YOY

|

2018

(Dec Estimate)

|

2018

% YOY

|

|

Television

|

24516

|

24607

|

10.7

|

27617

|

12.2

|

|

Print

|

20644

|

20613

|

5.6

|

21842

|

6.0

|

|

Digital

|

10227

|

10227

|

28.0

|

12808

|

25.2

|

|

OOH

|

3552

|

3411

|

8.0

|

3743

|

9.7

|

|

Radio

|

2227

|

2114

|

7.2

|

2325

|

10.0

|

|

Total

|

61166

|

60972

|

11.1

|

68334

|

12.1

|

Table 2 – Net Advertising Revenues: 2018-2022 (INR bn Net)

Table 3 – Net Advertising Revenues: Top 10 markets ($ Bn)