‘Standardisation of formats, right pricing of media, upskilling of workforce, first party data application key to pDOOH growth in India’

By M4G Bureau - March 17, 2022

Dipankar Sanyal, CEO, Platinum OOH, Vinkoo Chakraborty, Business Head, Rapport, Gulab Patil, CEO of Lemma, and Syed Haseeb Arfath, Chief Technology Officer, Signpost India brought forth the key factors that will determine the success of programmatic DOOH in India markets.

Dipankar Sanyal set the tone for the session by referring to the huge potentials for pDOOH in India as the business embraces digital OOH in a big way. As the external business environment improves, this would be an opportune time for Indian OOH to push ahead on the programmatic front, and that would be of the essence to a swathe of advertising brands that seek greater RoI from this medium.

Vinkoo Chakraborty in her presentation underlined the need for a collaborative effort among media owners, exchanges, platforms, technical partners, specialist agencies, and indeed advertisers to make programmatic cannot work. She cited the key expectations from the different groups as follows:

- Media owners will be called upon to provide relevant locations, better screens, compatible software, rational pricing of their assets, log & monitoring reports, audience profiling.

- Exchanges / platform aggregators will be required to offer scalable reach, better connectivity with the media owners, compatible software, access to best DOOH inventories, real-time installation alerts, log & monitoring reports, audience profiling, retargeting capabilities.

- The various technical partners will need to bring to the table data harnessing capabilities, software & hardware integration, data support.

- Specialist agencies and advertisers on their part would have to demonstrate the willingness to explore new paradigms/new pilots, undertake upskilling of teams, and have the readiness to experiment.

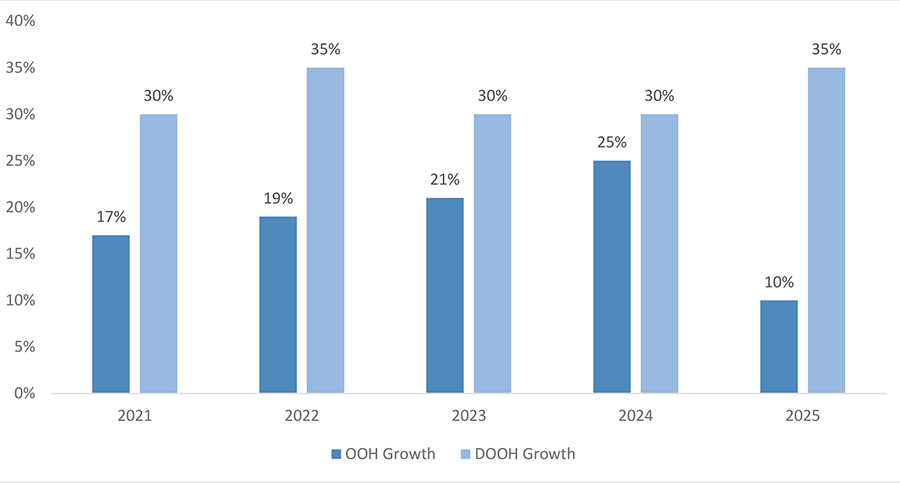

The pDOOH growth is predicated to the growth forecast for DOOH, as illustrated in Graph 1.

Graph 1: OOH & DOOH Growth rates (2021-2025)

Source: Magna-Global Ad Forecasts 2021, Rapport Market Intelligence

Graph 2 shows where pDOOH will deliver greater outcomes.

Vinkoo laid emphasis on upskilling of workforce as lines between media channels get increasingly getting blurred.

She said that pDOOH will spur OOH growth if the following aspects are focused upon:

- Better cost management of OOH assets -- ooh is becoming expensive

- Standardisation of OOH sites/structures

- Automated monitoring of traditional OOH

- Sharing of available case studies on OOH advertising

- Development of industry measurement metrics

- Location Intelligence

- Technology integrations

- Automated DOOH

- pDOOH

Stating at the outset that “media owners are the kings. You need to understand the potential, power and strength of the media”, Gulab Patil said that currently OOH is like a blackbox – brands are not sufficiently aware of the media. “pDOOH will give direct connection with the brand,” he asserted.

Gulab pointed out that programmatic DOOH is all about focusing on the audience. “It is essential to provide location data, audience data, audience insights, detailed segmentation of audiences, so that this media becomes part of the information ecosystem,” he said, while adding that pDOOH potentials are expanding with more DOOH screens coming in, smart city projects gaining traction, etc.

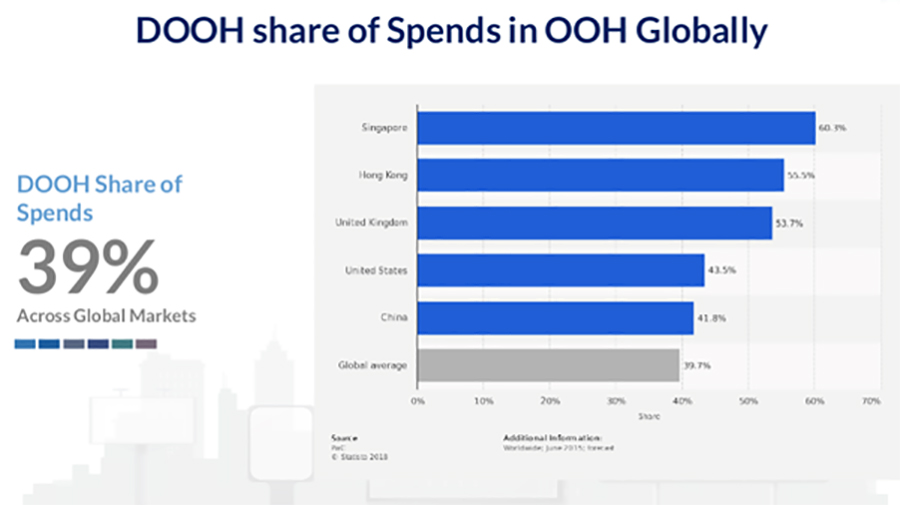

He cited that DOOH revenues will likely double by 2025 to reach $34bn, as illustrated in Graph 3:

Graph 3: Global DOOH share of spends

He cited that 98% of the campaigns executed by Lemma in 2021 were through DSPs.

Sharing his perspective on ‘How Hyperlocal data can power pDOOH adoption in India’,

Syed Haseeb Arfath said that currently DOOH has a 4% share of OOH business that translates to Rs 150 crore, coming from some 60,000 screens. Most mature markets that have invested in DOOH for decades see this share at 20%. He said that India could learn from the experience of other markets and thus leapfrog in the DOOH space.

Haseeb categorically stated that the DOOH growth will be greatly determined by the RoI calculation and adex data. “To grow at scale we need to invest in first party data acquisition that bring out the character of each individual asset,” he said, adding that that’s when hyperlocal programmatic will gain traction.

The panel discussion was moderated by Rajiv Raghunath, Managing Editor of Media4Growth.

Stay on top of OOH media trends