Making haste, slowly

By Rajiv Raghunath - April 11, 2023

Specialist agency heads take stock of how pDOOH is shaping up in India

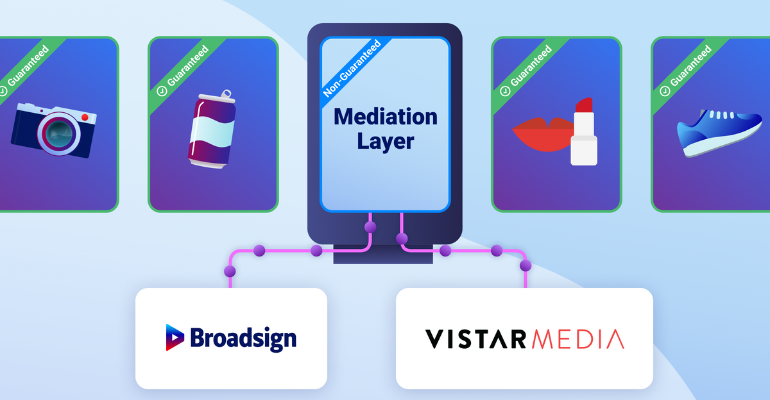

A report on programmatic DOOH trends in the US released by the supply side platform (SSP) Place Exchange in early March is illustrative of the onward march of pDOOH business. The report, based on comparative data covering H1 2022 and H2 2022, states that “billboards continue to be the largest single asset category by spend, but with increasing screen counts, other formats (notably place-based screens/TVs, display panels, and kiosks) have grown to represent a significant portion of overall programmatic OOH spend.”

The report also cites that “video continues to represent a sizeable portion of spending, at roughly 40% of programmatic OOH spend on video-enabled screens.”

In terms of advertising categories, the fastest grown in the pDOOH space were shopping, personal finance, careers, food/drink, arts/entertainment, and health/fitness.

In terms of advertising categories, the fastest grown in the pDOOH space were shopping, personal finance, careers, food/drink, arts/entertainment, and health/fitness.

Closer home, over the last two years that has been a significant increase in the number of DOOH assets coming up in varied formats – roadside, place-based, etc. With markets like the US, UK and Australia seeing an increasing share of DOOH spends through programmatic planning and buying, will a similar pattern emerge in the Indian market?

Responding to this question, Jayesh Yagnik, CEO, MOMS Outdoor, says, “DOOH will continue to be the growth driver with its big bright displays. Along with Destination DOOH, digital displays are continuously growing on road across markets. We estimate that DOOH screens have grown from 26k+ in 2020 to 57k + in 2021 to 90k + in 2022.  With growth in this universe, the investments of DOOH are also expected to increase thus increasing the share of the media. Programmatic DOOH which is at a nascent stage in India has almost 6% share in the current DOOH pie but is expected to significantly grow by 2025.”

With growth in this universe, the investments of DOOH are also expected to increase thus increasing the share of the media. Programmatic DOOH which is at a nascent stage in India has almost 6% share in the current DOOH pie but is expected to significantly grow by 2025.”

According to Haresh Nayak, Founder & CEO of Connect Network, “The last two years have been really great for India. The sheer increase in the number of DOOH screens has resulted in a lot of traction from clients. Also, some spectacular screens have come up in large formats, contributing to quality and impact on the overall DOOH scenario. However, pDOOH in India is at a nascent stage with connectivity, data and technology required for that ecosystem to take a firm shape.”

Dipankar Sanyal, CEO, Platinum OOH and MRP, “It is heartening to see that the DOOH pie in OOH is increasing day by day. The traditional formats converting to digital formats and increasing networks at destination touchpoints are helping the growth of digital OOH.”

Dipankar Sanyal, CEO, Platinum OOH and MRP, “It is heartening to see that the DOOH pie in OOH is increasing day by day. The traditional formats converting to digital formats and increasing networks at destination touchpoints are helping the growth of digital OOH.”

However, he also points out that “unfortunately in India, pDOOH remains a buzzword without any sting. Media owners are still happily selling the inventory the traditional way and why not if they can command a price. We do work very closely with the current adtech firms providing their platforms for pDOOH but the number of screens on their platforms are so low that planning a campaign programmatically is not possible. However, the market is huge and we haven’t scratched the surface yet.”

When asked about their particular experience with working with adtech companies that offer pDOOH platforms, Jayesh observes that “there are multiple pDOOH SSPs in business, but there are still some challenges that we face in on-ground execution and reporting.”

Haresh on the other hand asserts that “there are a few SSPs that have been working in India and have been doing a great job. We feel the market is doing basic programmatic buying as of now which is also far and few. Our experience has been great and we are seeing multiple innovations coming through from the client end.”

Would pDOOH buying step up once the global majors establish their India footprints? On this, Jayesh says, “Yes, we think it will step up but that might take some more time to reach the benchmark due to various challenges seen in a large country like India. One of them being the fragmented market and lack of adoption of similar technology by all stakeholders.”

Haresh agrees with the view that pDOOH buying will step up once we have competition and technology making the ecosystem complete.

From an agency perspective, how do you see pDOOH contributing to the business growth? Jayesh responds to this question by saying, “pDOOH is the future of DOOH and we look forward to it. Currently, we are using both DOOH and pDOOH. However, use of DOOH is more extensive as compared to pDOOH which is used for select campaigns and innovative visibility. We would however look ahead to enhancing the usage of both.”

“I think this will create more value for the agency to strategise and plan effectively for the clients. Indirectly this will help to consolidate the spends and add scale to agency business,” adds Haresh.

Get exclusive access to OOH platform Here

Stay on top of OOH media trends