Large format printer market posts strong growth in Q1 2018: IDC Report

By M4G Bureau - May 23, 2018

The revival in corporate spending leads to surge in demand; solvent printers dominated the total graphics market but aqueous, UV and Latex were key drivers of this growth

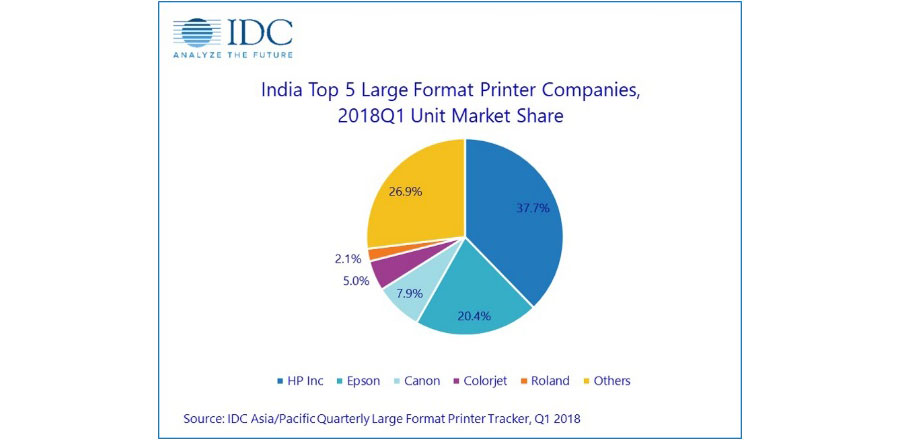

The large format printer (LFP) market in India grew 11.7% quarter-on-quarter and 38.5% year-on-year in Q1 2018, with shipments reaching at 2,954 units, according to the IDC Asia-Pacific Quarterly Large Format Printer Tracker, 2018Q1.

Shipments in the large format CAD/Technical printer market segment grew 17.7% quarter-on-quarter and 55.2% year-on-year, driven by strong growth in single-pass CAD inkjet printers in the large format aqueous-based printer segment. On the other hand, shipments on the graphics side were up by 7.6% quarter-on-quarter and 28.3% year-on-year. Though solvent printers dominate the total graphics market but aqueous, UV and Latex were key drivers of this growth.

Segment Highlights

Segment Highlights

CAD: Demonetisation, GSTs and RERA have affected the real estate market in 2017. As market is stabilising in 2018 and further government has announced various infrastructure projects, this has fuelled shipment of CAD printers in India. HP remained market leader with unit market share of 68.5%, followed by Canon and Epson.

Graphics: Though solvents dominate the graphics market in India by capsizing over 40% share in the market because of their low acquisition and running cost, however during the quarter, high-end Aqueous and UV market helped the overall graphics market to grow. While Aqueous market posted quarter-on-quarter growth of 72.8% and year-on-year growth of 227.5%, on the other hand UV market posted quarter-on-quarter growth of 48.9% and year-on-year growth of 84.2%. Among other offerings aqueous/dye-sublimation market posted strong year-on-year growth but declined sequentially.

In terms of vendors’ ranking, Epson remained overall market leader in graphics segment, followed by HP. Among local vendors Colorjet maintained its market leader position, followed by Astrojet and Monotech. Colorjet is also the leader in UV segment followed by Monotech and Fujifilm.

“With the growing environmental concerns, new media and graphics application market in India is moving towards environment-friendly products even if they are priced high. This quarter witnessed more installation of UV and other high-end LFPs as compared to previous quarters,” says Pankaj Chawla, Research Manager, IPDS, IDC.